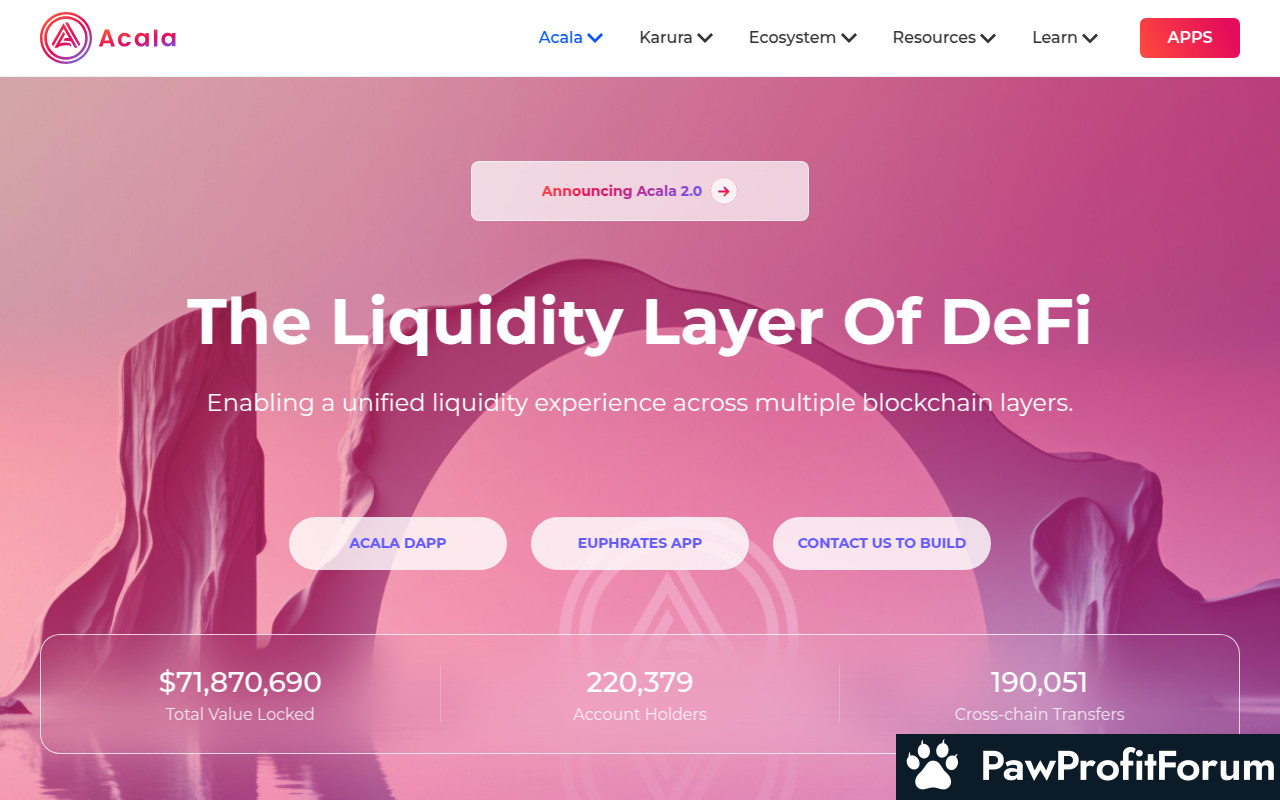

Acala is building the liquidity layer for web3 finance that is captive and sustainable. It aims to provide infrastructures for HyFi (DeFi+CeFi) solutions with crypto and real-world assets. Acala offers a Universal Asset Hub that hosts multichain liquid staking token (LST) protocols (such as liquid DOT - LDOT), an AMM decentralized exchange, and an app platform that is EVM-compatible and highly customizable (based on Substrate). Acala is secured by Polkadot, and is the liquidity gateway of Polkadot parachains and L1/L2 blockchains.

The Acala Network aims to create a sustainable liquidity layer for web3 finance, blending decentralized and centralized finance (HyFi) solutions. It provides infrastructures that support both crypto and real-world assets. One of its key offerings is the Universal Asset Hub, which hosts multichain liquid staking token (LST) protocols, such as liquid DOT (LDOT). This hub also features an automated market maker (AMM) decentralized exchange and a customizable app platform that is EVM-compatible, built on Substrate.

Secured by Polkadot, Acala acts as the liquidity gateway for Polkadot parachains and Layer 1/Layer 2 blockchains. The network's composable DeFi stack allows for advanced financial operations, leveraging oracle feeds for smart contract development. This composability ensures that developers can create sophisticated financial products with ease, enhancing the overall ecosystem.

In addition to its technical capabilities, ACA is pivotal for governance, allowing token holders to participate in decision-making processes that shape the future of the network. This democratic approach ensures that the community has a say in protocol upgrades and other critical changes.

The blockchain on which Acala Token operates, Polkadot, is designed to support multiple interconnected blockchains, known as parachains. This architecture enhances scalability and interoperability, allowing different blockchains to communicate and share information securely. Polkadot's consensus mechanism, known as Nominated Proof-of-Stake (NPoS), plays a crucial role in maintaining the network's security. Validators are selected based on their stake and reputation, ensuring that only trustworthy participants can validate transactions. This mechanism helps prevent attacks from bad actors by making it economically unfeasible to compromise the network.

Acala's technology stack extends beyond the EVM and Polkadot's core features. The platform offers a Universal Asset Hub that supports multichain liquid staking token (LST) protocols, such as liquid DOT (LDOT). This hub acts as a liquidity layer for web3 finance, integrating both decentralized finance (DeFi) and centralized finance (CeFi) solutions. By bridging crypto assets with real-world assets, Acala aims to create a sustainable and captive liquidity infrastructure.

One of the standout features of Acala is its AMM (Automated Market Maker) decentralized exchange, which facilitates seamless trading of assets within the ecosystem. The platform's app layer is highly customizable and EVM-compatible, built on Substrate, a modular framework for building blockchains. This customization allows developers to tailor their applications to specific needs, enhancing the overall functionality and user experience.

Acala's integration with Polkadot also brings additional security benefits. Polkadot's relay chain coordinates the network's shared security, ensuring that all connected parachains, including Acala, benefit from a unified security model. This shared security reduces the risk of individual chain attacks and enhances the overall resilience of the ecosystem.

Partnerships with industry leaders further bolster Acala's technological capabilities. These collaborations enable the platform to integrate cutting-edge solutions and expand its use cases within the Acala ecosystem. As a key player in the Polkadot ecosystem, Acala is positioned to leverage these partnerships to drive innovation and growth.

The Acala EVM's composable DeFi stack is another critical component of the technology. This stack allows for the creation of complex financial products and services by combining various DeFi building blocks. The queryable and lightweight nature of the Acala EVM ensures efficient data retrieval and processing, which is essential for the smooth operation of DApps and other blockchain-based applications.

Acala's focus on providing a liquidity gateway for Polkadot parachains and L1/L2 blockchains underscores its commitment to enhancing interoperability and liquidity within the broader blockchain ecosystem. This gateway facilitates the seamless transfer of assets across different chains, promoting a more interconnected and efficient financial landscape.

The technology behind Acala Token is designed to support a wide range of use cases, from decentralized finance to real-world asset integration. By leveraging the strengths of Polkadot, the Acala EVM, and its Universal Asset Hub, Acala aims to create a comprehensive and resilient platform for the future of finance.

ACA also plays a crucial role in governance. Token holders can vote on important proposals that affect the network's future, such as protocol upgrades or changes to economic parameters. This decentralized decision-making process empowers the community and ensures that the network evolves according to the collective will of its users.

In the realm of decentralized finance (DeFi), ACA is used for staking in the Homa protocol. This allows users to earn rewards by locking their tokens, contributing to network security, and participating in the issuance of liquid staking tokens like LDOT. These tokens can then be used in various DeFi applications, providing liquidity and earning additional yields.

ACA serves as a bridge token for cross-chain listings, facilitating interoperability between different blockchain networks. This capability is essential for creating a seamless user experience and enabling the transfer of assets across various platforms. The token's utility extends to building decentralized applications (dApps) on Acala's EVM-compatible platform, which is highly customizable and based on Substrate.

Additionally, ACA is used as a contingency solution for price drops within the Acala ecosystem. This function helps stabilize the network during periods of high volatility, ensuring that users' assets are protected and the system remains resilient.

Acala's Universal Asset Hub hosts multichain liquid staking token protocols and an AMM decentralized exchange, further enhancing the token's utility. By providing a liquidity gateway for Polkadot parachains and other blockchains, ACA supports a wide range of financial activities, from trading to lending and borrowing.

One of the pivotal moments for Acala Token was the launch of Acala 2.0. This upgrade introduced significant enhancements to the network's infrastructure, focusing on scalability and interoperability. The introduction of Acala Dollar (aUSD) and AcalaSwap marked another milestone, providing users with a stablecoin and a decentralized exchange platform, respectively. These additions significantly expanded the network's DeFi capabilities.

The implementation of Homa Liquid Staking was another key event. This feature allowed users to stake their DOT tokens and receive liquid DOT (LDOT) in return, enhancing liquidity and enabling more flexible asset management. The integration of Acala EVM+ further strengthened the network by providing a composable DeFi stack that supports smart contracts and decentralized applications, making it easier for developers to build on the platform.

A notable event was the redenomination of ACA, which adjusted the token's supply to improve its utility and accessibility. This move was aimed at aligning the tokenomics with the network's long-term goals and enhancing user experience. The launch of Trilogy Networks expanded Acala's ecosystem, fostering collaboration and innovation within the DeFi space.

The implementation of flexible fees was another significant development. This feature allowed users to pay transaction fees in various supported tokens, not just ACA, making the network more user-friendly and accessible. This flexibility is particularly beneficial for users who may not hold ACA but still wish to interact with the network's services.

Acala's partnerships with major institutions, including Coinbase, have also played a crucial role in its growth. These collaborations have helped increase the network's visibility and adoption, attracting more users and developers to the platform. The network's focus on providing infrastructures for HyFi solutions, combining DeFi and CeFi, has positioned it as a key player in the evolving financial landscape.

Acala's integration with the Polkadot ecosystem has been instrumental in its development. Being secured by Polkadot, Acala benefits from the network's robust security and interoperability features. This integration allows Acala to serve as the liquidity gateway for Polkadot parachains and other blockchain networks, further enhancing its utility and reach.

The introduction of the on-chain scheduler and the use of oracle feeds have also contributed to the network's robustness. These features enable more efficient and reliable execution of smart contracts and decentralized applications, ensuring that the network can support a wide range of use cases and maintain high performance.

Acala's continuous innovation and strategic partnerships have solidified its position in the DeFi space. The network's commitment to providing a comprehensive and user-friendly platform for decentralized finance has attracted a growing community of users and developers, driving its ongoing success and development.

What is Acala Token?

Acala Token (ACA) stands as a multifaceted cryptocurrency within the Acala Network, a decentralized finance (DeFi) hub on the Polkadot platform. ACA serves multiple roles, including governance, transaction fees, and staking, making it integral to the network's operations.The Acala Network aims to create a sustainable liquidity layer for web3 finance, blending decentralized and centralized finance (HyFi) solutions. It provides infrastructures that support both crypto and real-world assets. One of its key offerings is the Universal Asset Hub, which hosts multichain liquid staking token (LST) protocols, such as liquid DOT (LDOT). This hub also features an automated market maker (AMM) decentralized exchange and a customizable app platform that is EVM-compatible, built on Substrate.

Secured by Polkadot, Acala acts as the liquidity gateway for Polkadot parachains and Layer 1/Layer 2 blockchains. The network's composable DeFi stack allows for advanced financial operations, leveraging oracle feeds for smart contract development. This composability ensures that developers can create sophisticated financial products with ease, enhancing the overall ecosystem.

In addition to its technical capabilities, ACA is pivotal for governance, allowing token holders to participate in decision-making processes that shape the future of the network. This democratic approach ensures that the community has a say in protocol upgrades and other critical changes.

What is the technology behind Acala Token?

Acala Token (ACA) is a cornerstone of the Acala Network, a decentralized finance (DeFi) platform built on the Polkadot blockchain. The technology behind Acala Token is multifaceted, integrating various advanced components to create a robust and versatile ecosystem. At the heart of this technology is the Acala EVM (Ethereum Virtual Machine), which allows developers to create, test, and deploy decentralized applications (DApps) using familiar tools like Remix and Waffle. This compatibility ensures that developers can seamlessly interact with Acala nodes through the web3 provider bodhi.js, facilitating a smooth development experience.The blockchain on which Acala Token operates, Polkadot, is designed to support multiple interconnected blockchains, known as parachains. This architecture enhances scalability and interoperability, allowing different blockchains to communicate and share information securely. Polkadot's consensus mechanism, known as Nominated Proof-of-Stake (NPoS), plays a crucial role in maintaining the network's security. Validators are selected based on their stake and reputation, ensuring that only trustworthy participants can validate transactions. This mechanism helps prevent attacks from bad actors by making it economically unfeasible to compromise the network.

Acala's technology stack extends beyond the EVM and Polkadot's core features. The platform offers a Universal Asset Hub that supports multichain liquid staking token (LST) protocols, such as liquid DOT (LDOT). This hub acts as a liquidity layer for web3 finance, integrating both decentralized finance (DeFi) and centralized finance (CeFi) solutions. By bridging crypto assets with real-world assets, Acala aims to create a sustainable and captive liquidity infrastructure.

One of the standout features of Acala is its AMM (Automated Market Maker) decentralized exchange, which facilitates seamless trading of assets within the ecosystem. The platform's app layer is highly customizable and EVM-compatible, built on Substrate, a modular framework for building blockchains. This customization allows developers to tailor their applications to specific needs, enhancing the overall functionality and user experience.

Acala's integration with Polkadot also brings additional security benefits. Polkadot's relay chain coordinates the network's shared security, ensuring that all connected parachains, including Acala, benefit from a unified security model. This shared security reduces the risk of individual chain attacks and enhances the overall resilience of the ecosystem.

Partnerships with industry leaders further bolster Acala's technological capabilities. These collaborations enable the platform to integrate cutting-edge solutions and expand its use cases within the Acala ecosystem. As a key player in the Polkadot ecosystem, Acala is positioned to leverage these partnerships to drive innovation and growth.

The Acala EVM's composable DeFi stack is another critical component of the technology. This stack allows for the creation of complex financial products and services by combining various DeFi building blocks. The queryable and lightweight nature of the Acala EVM ensures efficient data retrieval and processing, which is essential for the smooth operation of DApps and other blockchain-based applications.

Acala's focus on providing a liquidity gateway for Polkadot parachains and L1/L2 blockchains underscores its commitment to enhancing interoperability and liquidity within the broader blockchain ecosystem. This gateway facilitates the seamless transfer of assets across different chains, promoting a more interconnected and efficient financial landscape.

The technology behind Acala Token is designed to support a wide range of use cases, from decentralized finance to real-world asset integration. By leveraging the strengths of Polkadot, the Acala EVM, and its Universal Asset Hub, Acala aims to create a comprehensive and resilient platform for the future of finance.

What are the real-world applications of Acala Token?

Acala Token (ACA) is integral to the Acala network, which aims to create a robust financial infrastructure for the decentralized web. One of its primary applications is paying network transaction fees, stability fees, and penalty fees within the Acala ecosystem. This ensures smooth operations and incentivizes network participants to maintain the system's integrity.ACA also plays a crucial role in governance. Token holders can vote on important proposals that affect the network's future, such as protocol upgrades or changes to economic parameters. This decentralized decision-making process empowers the community and ensures that the network evolves according to the collective will of its users.

In the realm of decentralized finance (DeFi), ACA is used for staking in the Homa protocol. This allows users to earn rewards by locking their tokens, contributing to network security, and participating in the issuance of liquid staking tokens like LDOT. These tokens can then be used in various DeFi applications, providing liquidity and earning additional yields.

ACA serves as a bridge token for cross-chain listings, facilitating interoperability between different blockchain networks. This capability is essential for creating a seamless user experience and enabling the transfer of assets across various platforms. The token's utility extends to building decentralized applications (dApps) on Acala's EVM-compatible platform, which is highly customizable and based on Substrate.

Additionally, ACA is used as a contingency solution for price drops within the Acala ecosystem. This function helps stabilize the network during periods of high volatility, ensuring that users' assets are protected and the system remains resilient.

Acala's Universal Asset Hub hosts multichain liquid staking token protocols and an AMM decentralized exchange, further enhancing the token's utility. By providing a liquidity gateway for Polkadot parachains and other blockchains, ACA supports a wide range of financial activities, from trading to lending and borrowing.

What key events have there been for Acala Token?

Acala Token (ACA) is integral to the Acala Network, a decentralized finance platform built on the Polkadot network. Acala aims to create a sustainable liquidity layer for web3 finance, combining decentralized and centralized finance solutions with both crypto and real-world assets. The network offers a Universal Asset Hub, hosting multichain liquid staking token protocols, an AMM decentralized exchange, and an EVM-compatible app platform.One of the pivotal moments for Acala Token was the launch of Acala 2.0. This upgrade introduced significant enhancements to the network's infrastructure, focusing on scalability and interoperability. The introduction of Acala Dollar (aUSD) and AcalaSwap marked another milestone, providing users with a stablecoin and a decentralized exchange platform, respectively. These additions significantly expanded the network's DeFi capabilities.

The implementation of Homa Liquid Staking was another key event. This feature allowed users to stake their DOT tokens and receive liquid DOT (LDOT) in return, enhancing liquidity and enabling more flexible asset management. The integration of Acala EVM+ further strengthened the network by providing a composable DeFi stack that supports smart contracts and decentralized applications, making it easier for developers to build on the platform.

A notable event was the redenomination of ACA, which adjusted the token's supply to improve its utility and accessibility. This move was aimed at aligning the tokenomics with the network's long-term goals and enhancing user experience. The launch of Trilogy Networks expanded Acala's ecosystem, fostering collaboration and innovation within the DeFi space.

The implementation of flexible fees was another significant development. This feature allowed users to pay transaction fees in various supported tokens, not just ACA, making the network more user-friendly and accessible. This flexibility is particularly beneficial for users who may not hold ACA but still wish to interact with the network's services.

Acala's partnerships with major institutions, including Coinbase, have also played a crucial role in its growth. These collaborations have helped increase the network's visibility and adoption, attracting more users and developers to the platform. The network's focus on providing infrastructures for HyFi solutions, combining DeFi and CeFi, has positioned it as a key player in the evolving financial landscape.

Acala's integration with the Polkadot ecosystem has been instrumental in its development. Being secured by Polkadot, Acala benefits from the network's robust security and interoperability features. This integration allows Acala to serve as the liquidity gateway for Polkadot parachains and other blockchain networks, further enhancing its utility and reach.

The introduction of the on-chain scheduler and the use of oracle feeds have also contributed to the network's robustness. These features enable more efficient and reliable execution of smart contracts and decentralized applications, ensuring that the network can support a wide range of use cases and maintain high performance.

Acala's continuous innovation and strategic partnerships have solidified its position in the DeFi space. The network's commitment to providing a comprehensive and user-friendly platform for decentralized finance has attracted a growing community of users and developers, driving its ongoing success and development.

Who are the founders of Acala Token?

Acala Token (ACA) is at the forefront of creating a sustainable liquidity layer for web3 finance, integrating both decentralized and centralized finance solutions. The masterminds behind Acala Token are Antonia Chen, Bette Chen, Bryan Chen, Fuyao Jiang, and Ruitao Su. These founders bring a wealth of experience from diverse fields such as finance, software engineering, and blockchain technology. Their collective expertise has been instrumental in developing Acala's Universal Asset Hub, which supports multichain liquid staking token protocols, an AMM decentralized exchange, and a customizable app platform secured by Polkadot.| Website | acala.network/ |

| Website | wiki.acala.network/ |

| Socials | twitter.com/AcalaNetwork |

| Socials | reddit.com/r/acalanetwork |

| Socials | github.com/AcalaNetwork |

| Socials | t.me/acalaofficial |

| Explorers | acala.subscan.io/ |