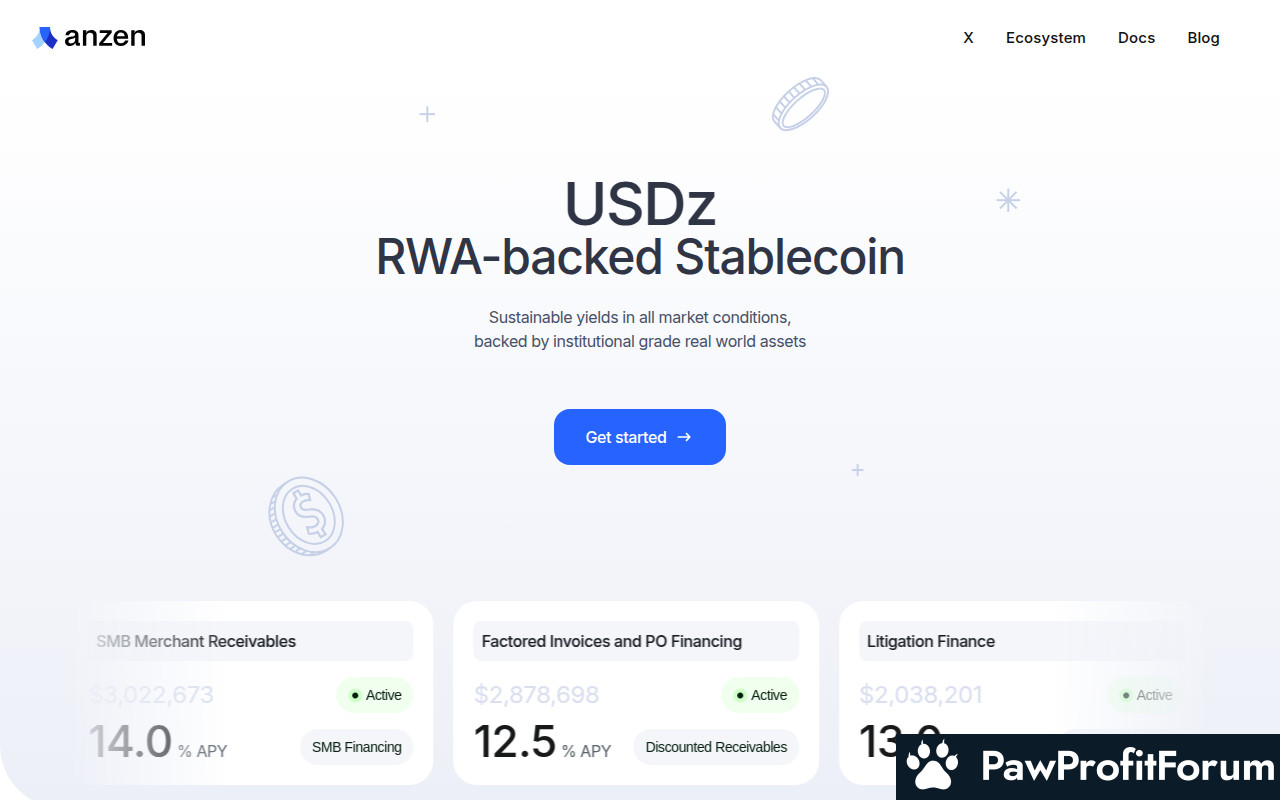

Anzen is a decentralized platform providing access to USDz, which is a stablecoin backed by a diversified portfolio of private credit assets.

These cash-flowing assets are carefully selected alongside qualified KYC-compliant investors through rigorous underwriting. The portfolio is expected to maintain its value even during periods of cryptocurrency market volatility.

USDz is fully composable, and allows holders to benefit from the stabilty of RWA with less volatility than speculative tokens.

The platform allows users to stake USDz tokens and earn sustainable rewards, leveraging the expertise of a team of credit investment professionals. This staking mechanism not only incentivizes participation but also ensures that users can benefit from the stability of real-world assets (RWA) without the high volatility associated with speculative tokens.

Anzen Finance has also secured $4 million in seed funding from various investors, highlighting the confidence in its innovative approach to integrating credit assets on-chain. The stablecoin USDz is fully composable, meaning it can be freely traded on decentralized exchanges, providing liquidity and flexibility to its holders.

In addition to its stablecoin offering, Anzen Finance provides access to private credit assets and funding opportunities, broadening the scope of investment options available to its users. This multi-faceted approach positions Anzen Finance as a unique player in the DeFi ecosystem, bridging traditional finance with blockchain technology.

The blockchain technology behind Anzen Finance is designed to facilitate the adoption of institutional-grade private credit assets. By utilizing a decentralized ledger, Anzen Finance ensures transparency and security in all transactions. Each transaction is recorded on the blockchain, making it immutable and verifiable by anyone. This transparency is crucial in maintaining trust among investors and users.

To prevent attacks from bad actors, Anzen Finance employs several security measures inherent to blockchain technology. One of the primary defenses is the use of cryptographic algorithms to secure data. These algorithms ensure that only authorized parties can access and modify information on the blockchain. Additionally, the decentralized nature of the blockchain means that there is no single point of failure. This decentralization makes it extremely difficult for hackers to compromise the system, as they would need to gain control of a majority of the network's nodes.

Anzen Finance also incorporates sustainable DeFi yields and loss protection for private credit investors. This means that investors can earn returns on their investments while having a safety net in place to protect against potential losses. The platform achieves this through rigorous underwriting processes and careful selection of cash-flowing assets. These assets are chosen alongside qualified KYC-compliant investors, ensuring that only high-quality investments are included in the portfolio.

Furthermore, USDZ is fully composable, allowing holders to benefit from the stability of real-world assets (RWA) with less volatility than speculative tokens. This composability means that USDZ can be easily integrated into various DeFi applications, providing users with a versatile and stable digital asset. The diversified portfolio backing USDZ includes private credit assets that generate consistent cash flows, further enhancing the token's stability.

In addition to these features, Anzen Finance's platform is designed to be user-friendly and accessible to a wide range of investors. The use of blockchain technology ensures that all transactions are transparent and secure, while the diversified portfolio of private credit assets provides a stable foundation for USDZ. This combination of advanced technology and careful asset selection makes Anzen Finance a robust and reliable platform for investors seeking stability and security in the volatile world of cryptocurrency.

Another significant application of Anzen Finance is its integration into decentralized finance (DeFi) protocols. Users can participate in various DeFi activities, such as lending, borrowing, and yield farming, using USDZ. This provides an opportunity to earn interest or rewards while leveraging the stability of the stablecoin.

Staking is another key feature of Anzen Finance. By staking USDZ, users can earn rewards, contributing to the network's security and stability. This process involves locking up a certain amount of USDZ for a specified period, during which users receive incentives for their participation.

USDZ is backed by a diversified portfolio of institutional-grade real-world assets, primarily composed of asset-backed private credit securities. These assets are carefully selected through rigorous underwriting processes and involve qualified KYC-compliant investors. This backing ensures that USDZ maintains its value even during periods of cryptocurrency market volatility, providing a reliable store of value.

Anzen Finance also allows users to tap into real-world assets, reducing reliance on the often volatile cryptocurrency markets. This feature is particularly beneficial for those looking to diversify their investment portfolios with more stable and predictable returns.

Additionally, USDZ can be used in partner decentralized applications (dApps), enhancing its utility within the broader blockchain ecosystem. This integration allows users to access various services and products, further embedding USDZ into everyday financial activities.

The composability of USDZ means it can seamlessly interact with other digital assets and platforms, enhancing its versatility and adoption across different financial services. This characteristic makes USDZ a valuable tool for both individual users and institutional investors seeking stability and efficiency in their financial operations.

One of the pivotal moments for Anzen Finance was the launch of their platform, which opened new avenues for investors seeking stability in the volatile cryptocurrency market. By offering USDz, Anzen Finance provided a unique opportunity for investors to engage with a stablecoin backed by real-world assets, ensuring a more secure investment.

In their quest to expand and solidify their presence, Anzen Finance formed strategic partnerships with various companies. These collaborations were crucial in enhancing the platform's capabilities and reach, allowing for a broader adoption of USDz. The partnerships also facilitated the integration of advanced technologies and services, further strengthening the platform's infrastructure.

A significant development for Anzen Finance was their participation in the Chainlink BUILD program. This initiative aimed to accelerate the growth of their ecosystem by leveraging Chainlink's industry-leading decentralized oracle networks. By joining this program, Anzen Finance could enhance the security and reliability of their platform, ensuring that USDz remained a trusted and stable asset for investors.

Anzen Finance also made headlines by providing loss protection for private credit investors through their platform. This feature was designed to safeguard investors' interests, offering an additional layer of security and confidence in their investments. By mitigating potential losses, Anzen Finance reinforced its commitment to protecting its users and maintaining the stability of USDz.

Another noteworthy event was the change of their URL, which marked a significant step in their branding and online presence. This change was part of a broader strategy to streamline their digital identity and make their platform more accessible to users. The updated URL facilitated easier access to information and services, enhancing the overall user experience.

Anzen Finance's dedication to transparency and security was evident through their rigorous underwriting process. By carefully selecting cash-flowing assets and working with qualified KYC-compliant investors, Anzen Finance ensured that the portfolio backing USDz maintained its value, even during periods of cryptocurrency market volatility. This meticulous approach underscored their commitment to providing a stable and reliable investment option.

The platform's composability allowed USDz holders to benefit from the stability of real-world assets (RWA) while enjoying the flexibility and utility of a digital token. This feature made USDz an attractive option for investors looking to diversify their portfolios without exposing themselves to the high volatility typically associated with cryptocurrencies.

Anzen Finance's journey has been marked by strategic moves and innovative solutions, positioning them as a key player in the decentralized finance space. Their efforts to provide a stable and secure investment option through USDz have resonated with investors, highlighting the potential of blockchain technology to revolutionize traditional financial systems.

These cash-flowing assets are carefully selected alongside qualified KYC-compliant investors through rigorous underwriting. The portfolio is expected to maintain its value even during periods of cryptocurrency market volatility.

USDz is fully composable, and allows holders to benefit from the stabilty of RWA with less volatility than speculative tokens.

What is Anzen Finance?

Anzen Finance stands out in the decentralized finance (DeFi) space by offering a stablecoin, USDz, which is backed by real-world assets. Unlike fiat stablecoins such as USDC or USDT, USDz is supported by a diversified portfolio of private credit assets. These assets are meticulously selected through rigorous underwriting processes and involve qualified, KYC-compliant investors. This approach aims to provide stability and maintain value even during volatile cryptocurrency market conditions.The platform allows users to stake USDz tokens and earn sustainable rewards, leveraging the expertise of a team of credit investment professionals. This staking mechanism not only incentivizes participation but also ensures that users can benefit from the stability of real-world assets (RWA) without the high volatility associated with speculative tokens.

Anzen Finance has also secured $4 million in seed funding from various investors, highlighting the confidence in its innovative approach to integrating credit assets on-chain. The stablecoin USDz is fully composable, meaning it can be freely traded on decentralized exchanges, providing liquidity and flexibility to its holders.

In addition to its stablecoin offering, Anzen Finance provides access to private credit assets and funding opportunities, broadening the scope of investment options available to its users. This multi-faceted approach positions Anzen Finance as a unique player in the DeFi ecosystem, bridging traditional finance with blockchain technology.

What is the technology behind Anzen Finance?

Anzen Finance stands out in the world of decentralized finance (DeFi) by leveraging blockchain technology to bridge the gap between traditional finance and the digital economy. At its core, Anzen Finance operates on a decentralized platform that provides access to USDZ, a digital token backed by a diversified portfolio of private credit assets. This unique approach ensures that the value of USDZ remains stable, even during periods of cryptocurrency market volatility.The blockchain technology behind Anzen Finance is designed to facilitate the adoption of institutional-grade private credit assets. By utilizing a decentralized ledger, Anzen Finance ensures transparency and security in all transactions. Each transaction is recorded on the blockchain, making it immutable and verifiable by anyone. This transparency is crucial in maintaining trust among investors and users.

To prevent attacks from bad actors, Anzen Finance employs several security measures inherent to blockchain technology. One of the primary defenses is the use of cryptographic algorithms to secure data. These algorithms ensure that only authorized parties can access and modify information on the blockchain. Additionally, the decentralized nature of the blockchain means that there is no single point of failure. This decentralization makes it extremely difficult for hackers to compromise the system, as they would need to gain control of a majority of the network's nodes.

Anzen Finance also incorporates sustainable DeFi yields and loss protection for private credit investors. This means that investors can earn returns on their investments while having a safety net in place to protect against potential losses. The platform achieves this through rigorous underwriting processes and careful selection of cash-flowing assets. These assets are chosen alongside qualified KYC-compliant investors, ensuring that only high-quality investments are included in the portfolio.

Furthermore, USDZ is fully composable, allowing holders to benefit from the stability of real-world assets (RWA) with less volatility than speculative tokens. This composability means that USDZ can be easily integrated into various DeFi applications, providing users with a versatile and stable digital asset. The diversified portfolio backing USDZ includes private credit assets that generate consistent cash flows, further enhancing the token's stability.

In addition to these features, Anzen Finance's platform is designed to be user-friendly and accessible to a wide range of investors. The use of blockchain technology ensures that all transactions are transparent and secure, while the diversified portfolio of private credit assets provides a stable foundation for USDZ. This combination of advanced technology and careful asset selection makes Anzen Finance a robust and reliable platform for investors seeking stability and security in the volatile world of cryptocurrency.

What are the real-world applications of Anzen Finance?

Anzen Finance, represented by the stablecoin USDZ, offers several real-world applications that cater to a diverse audience. One of the primary uses of USDZ is as a stablecoin for payments. Unlike many cryptocurrencies that experience significant price fluctuations, USDZ maintains a stable value, making it suitable for everyday transactions and financial planning.Another significant application of Anzen Finance is its integration into decentralized finance (DeFi) protocols. Users can participate in various DeFi activities, such as lending, borrowing, and yield farming, using USDZ. This provides an opportunity to earn interest or rewards while leveraging the stability of the stablecoin.

Staking is another key feature of Anzen Finance. By staking USDZ, users can earn rewards, contributing to the network's security and stability. This process involves locking up a certain amount of USDZ for a specified period, during which users receive incentives for their participation.

USDZ is backed by a diversified portfolio of institutional-grade real-world assets, primarily composed of asset-backed private credit securities. These assets are carefully selected through rigorous underwriting processes and involve qualified KYC-compliant investors. This backing ensures that USDZ maintains its value even during periods of cryptocurrency market volatility, providing a reliable store of value.

Anzen Finance also allows users to tap into real-world assets, reducing reliance on the often volatile cryptocurrency markets. This feature is particularly beneficial for those looking to diversify their investment portfolios with more stable and predictable returns.

Additionally, USDZ can be used in partner decentralized applications (dApps), enhancing its utility within the broader blockchain ecosystem. This integration allows users to access various services and products, further embedding USDZ into everyday financial activities.

The composability of USDZ means it can seamlessly interact with other digital assets and platforms, enhancing its versatility and adoption across different financial services. This characteristic makes USDZ a valuable tool for both individual users and institutional investors seeking stability and efficiency in their financial operations.

What key events have there been for Anzen Finance?

Anzen Finance, a decentralized platform, has made significant strides in the cryptocurrency landscape by introducing USDz, a stablecoin backed by a diversified portfolio of private credit assets. This innovative approach aims to provide stability and reduced volatility compared to speculative tokens, making it a notable player in the blockchain ecosystem.One of the pivotal moments for Anzen Finance was the launch of their platform, which opened new avenues for investors seeking stability in the volatile cryptocurrency market. By offering USDz, Anzen Finance provided a unique opportunity for investors to engage with a stablecoin backed by real-world assets, ensuring a more secure investment.

In their quest to expand and solidify their presence, Anzen Finance formed strategic partnerships with various companies. These collaborations were crucial in enhancing the platform's capabilities and reach, allowing for a broader adoption of USDz. The partnerships also facilitated the integration of advanced technologies and services, further strengthening the platform's infrastructure.

A significant development for Anzen Finance was their participation in the Chainlink BUILD program. This initiative aimed to accelerate the growth of their ecosystem by leveraging Chainlink's industry-leading decentralized oracle networks. By joining this program, Anzen Finance could enhance the security and reliability of their platform, ensuring that USDz remained a trusted and stable asset for investors.

Anzen Finance also made headlines by providing loss protection for private credit investors through their platform. This feature was designed to safeguard investors' interests, offering an additional layer of security and confidence in their investments. By mitigating potential losses, Anzen Finance reinforced its commitment to protecting its users and maintaining the stability of USDz.

Another noteworthy event was the change of their URL, which marked a significant step in their branding and online presence. This change was part of a broader strategy to streamline their digital identity and make their platform more accessible to users. The updated URL facilitated easier access to information and services, enhancing the overall user experience.

Anzen Finance's dedication to transparency and security was evident through their rigorous underwriting process. By carefully selecting cash-flowing assets and working with qualified KYC-compliant investors, Anzen Finance ensured that the portfolio backing USDz maintained its value, even during periods of cryptocurrency market volatility. This meticulous approach underscored their commitment to providing a stable and reliable investment option.

The platform's composability allowed USDz holders to benefit from the stability of real-world assets (RWA) while enjoying the flexibility and utility of a digital token. This feature made USDz an attractive option for investors looking to diversify their portfolios without exposing themselves to the high volatility typically associated with cryptocurrencies.

Anzen Finance's journey has been marked by strategic moves and innovative solutions, positioning them as a key player in the decentralized finance space. Their efforts to provide a stable and secure investment option through USDz have resonated with investors, highlighting the potential of blockchain technology to revolutionize traditional financial systems.

Who are the founders of Anzen Finance?

Anzen Finance, known for its stablecoin USDZ, was co-founded by Ben Shyong. Shyong is a seasoned software engineer with a diverse background spanning consumer web, healthcare, and government sectors. His role in the creation of Anzen Finance leverages his extensive experience, including his tenure as a senior manager at Walmart. Additionally, Shyong co-founded Evernew Capital, further showcasing his entrepreneurial spirit and expertise in the financial technology space.| Website | anzen.finance/ |

| Website | docs.anzen.finance/ |

| Socials | twitter.com/anzenfinance |

| Socials | t.me/AnzenCommunity |

| Contracts | 0xA469...A10067 |

| Explorers | etherscan.io/token/0xA469B7Ee9ee773642b3e93E842e5D9b5BaA10067 |