INTRO

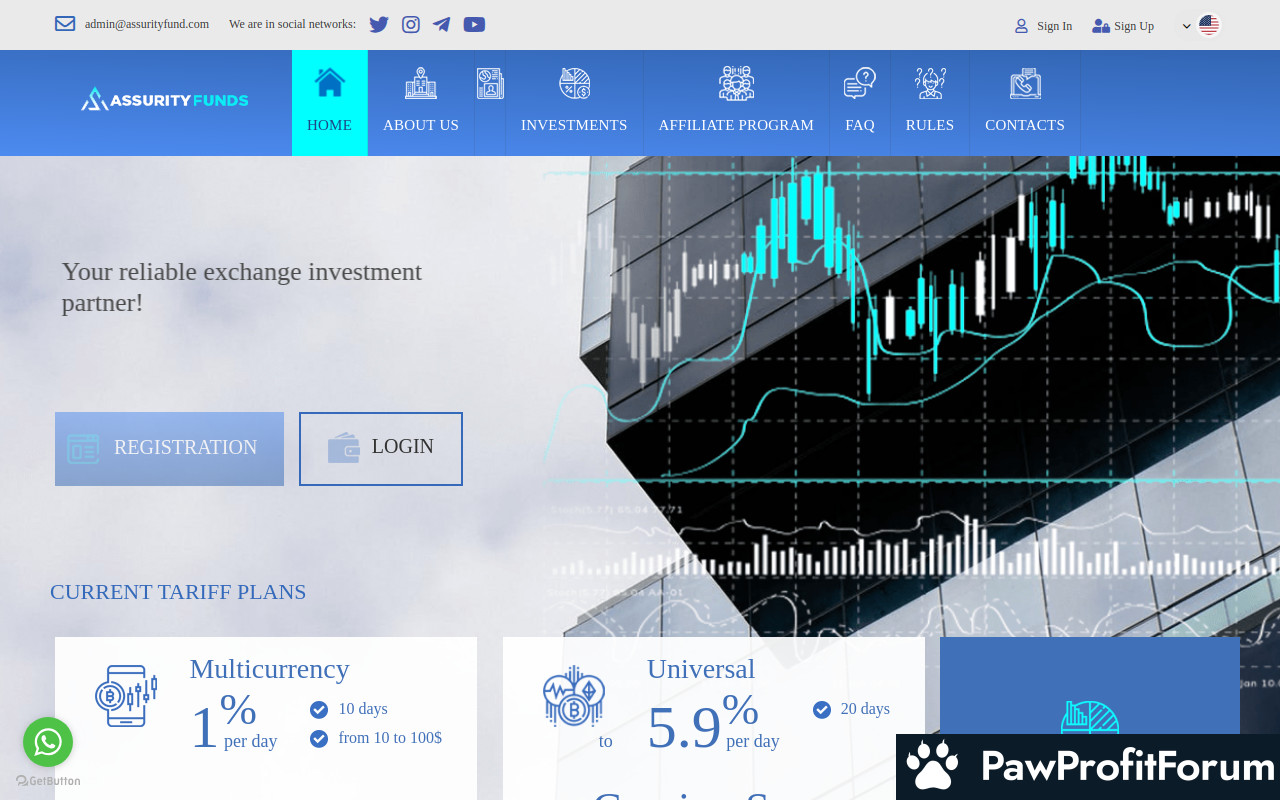

AssurityFund presents itself as a platform offering innovative financial solutions, potentially operating within the alternative financial service sector. It's crucial to carefully evaluate its legitimacy and claims before engaging with their services. This detailed review aims to provide an in-depth analysis of AssurityFund, covering its purported functions, potential benefits, and associated risks, enabling users to make informed decisions.

ALL YOU NEED TO KNOW AND HOW IT WORKS

AssurityFund claims to offer services related to financial growth. Understanding the specific mechanisms, investment strategies, or services provided by AssurityFund is crucial. This involves assessing the terms and conditions, fee structures, and potential returns. Transparency and clarity in their operational model are vital indicators of legitimacy.

What Makes AssurityFund Stand Out?

How to Maximize Your Experience on AssurityFund

Why Trust AssurityFund?

Determining the trustworthiness of AssurityFund requires careful scrutiny. Look for verifiable evidence of their registration, regulatory compliance, and financial stability. Transparent communication, positive user reviews (from reliable sources), and a clear explanation of their business model are essential for building trust. A lack of transparency, unrealistic promises, or pressure tactics should raise red flags.

FAQs

SUMMARY

AssurityFund is presented as a platform within the alternative financial service landscape. The importance of conducting due diligence, seeking independent financial advice, and exercising caution before engaging with such platforms is paramount. Scrutinize all claims, assess the associated risks, and verify the platform's legitimacy before making any financial commitments.

Given these insights, thorough research and caution are advised before engaging with AssurityFund.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

AssurityFund presents itself as a platform offering innovative financial solutions, potentially operating within the alternative financial service sector. It's crucial to carefully evaluate its legitimacy and claims before engaging with their services. This detailed review aims to provide an in-depth analysis of AssurityFund, covering its purported functions, potential benefits, and associated risks, enabling users to make informed decisions.

ALL YOU NEED TO KNOW AND HOW IT WORKS

AssurityFund claims to offer services related to financial growth. Understanding the specific mechanisms, investment strategies, or services provided by AssurityFund is crucial. This involves assessing the terms and conditions, fee structures, and potential returns. Transparency and clarity in their operational model are vital indicators of legitimacy.

What Makes AssurityFund Stand Out?

- Claims to offer innovative financial solutions.

- Potentially focuses on alternative financial services.

How to Maximize Your Experience on AssurityFund

- Thoroughly research and verify all claims made by AssurityFund.

- Consult with independent financial advisors before investing.

- Start with small, test investments to gauge the platform's performance.

- Document all transactions and communications.

Why Trust AssurityFund?

Determining the trustworthiness of AssurityFund requires careful scrutiny. Look for verifiable evidence of their registration, regulatory compliance, and financial stability. Transparent communication, positive user reviews (from reliable sources), and a clear explanation of their business model are essential for building trust. A lack of transparency, unrealistic promises, or pressure tactics should raise red flags.

FAQs

- What services does AssurityFund offer? AssurityFund claims to offer innovative financial solutions, but specific services may vary. Refer to their official website for detailed information.

- Is AssurityFund a legitimate platform? Thorough research is essential to determine the legitimacy of AssurityFund. Look for verifiable evidence of their registration, regulatory compliance, and financial stability. Consult with independent financial advisors before investing.

- What are the potential risks of using AssurityFund? Investing in any financial platform involves risks. Carefully assess the terms and conditions, fee structures, and potential returns before engaging with AssurityFund. A lack of transparency, unrealistic promises, or pressure tactics should raise concerns.

SUMMARY

AssurityFund is presented as a platform within the alternative financial service landscape. The importance of conducting due diligence, seeking independent financial advice, and exercising caution before engaging with such platforms is paramount. Scrutinize all claims, assess the associated risks, and verify the platform's legitimacy before making any financial commitments.

Given these insights, thorough research and caution are advised before engaging with AssurityFund.

Questions to Guide Your Review

- What has been your experience with AssurityFund's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does AssurityFund compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback