INTRO

coolcash.ca operates within the financial services sector, providing short-term lending solutions to individuals in need of quick financial assistance. It functions as a facilitator, connecting borrowers with lenders to secure payday loans and similar financial products. These services are often targeted towards individuals facing immediate expenses or those with limited access to traditional banking options. The platform aims to offer a streamlined process for accessing funds, but it's essential to approach such services with caution due to the associated high-interest rates and potential for debt accumulation. coolcash.ca is part of a broader ecosystem of online lending platforms, each with its own terms, conditions, and levels of transparency. Users should exercise due diligence and compare options to ensure they are making informed decisions that align with their financial circumstances. The accessibility and convenience of online lending can be appealing, but understanding the full implications of borrowing through these platforms is crucial.

ALL YOU NEED TO KNOW AND HOW IT WORKS

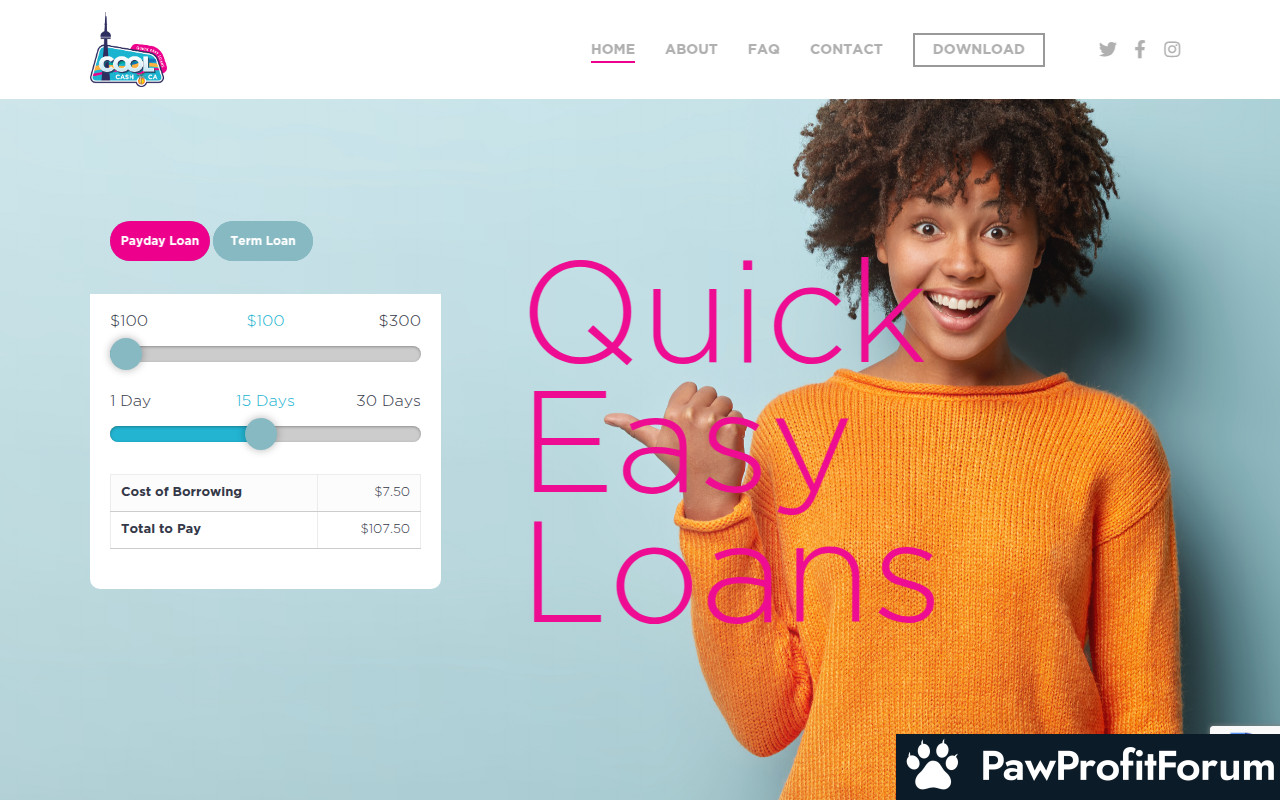

coolcash.ca acts as an intermediary between borrowers and lenders in the short-term loan market. Users typically complete an online application providing personal and financial information. coolcash.ca then uses this information to connect the applicant with potential lenders within its network. Once a lender approves the application, the loan terms, including interest rates, repayment schedules, and fees, are presented to the borrower. If the borrower agrees to the terms, the loan is disbursed, usually via electronic transfer to the borrower's bank account. Repayment is typically structured as a single payment on the borrower's next payday or in installments. The platform's ease of use and speed of access are key features, enabling users to quickly secure funds for urgent needs. However, it is vital for borrowers to thoroughly review the loan agreement and understand the total cost of borrowing before committing to a loan.

What Makes coolcash.ca Stand Out?

How to Maximize Your Experience on coolcash.ca

Why Trust coolcash.ca?

Trusting any lending platform requires careful consideration. coolcash.ca presents itself as a facilitator, connecting borrowers with lenders. While the platform may offer convenience, users should verify the credibility and reputation of the lenders within coolcash.ca's network. Look for transparent disclosures of interest rates, fees, and repayment terms. Check for independent reviews and ratings of the lenders to assess their reliability and customer service. Due diligence is crucial to ensure you are dealing with reputable lenders and avoid potential scams or predatory lending practices. coolcash.ca's trustworthiness ultimately depends on the lenders it connects users with and the transparency of the loan terms offered.

FAQs

SUMMARY

coolcash.ca provides a platform for individuals to access short-term loans by connecting them with a network of lenders. While the platform offers convenience and speed, users must exercise caution and conduct thorough due diligence to ensure they are dealing with reputable lenders and understand the full cost of borrowing. Comparing offers, reviewing loan terms carefully, and having a clear repayment plan are essential steps to maximizing your experience and avoiding potential financial pitfalls.

Given these insights, thorough research and caution are advised before engaging with coolcash.ca.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

coolcash.ca operates within the financial services sector, providing short-term lending solutions to individuals in need of quick financial assistance. It functions as a facilitator, connecting borrowers with lenders to secure payday loans and similar financial products. These services are often targeted towards individuals facing immediate expenses or those with limited access to traditional banking options. The platform aims to offer a streamlined process for accessing funds, but it's essential to approach such services with caution due to the associated high-interest rates and potential for debt accumulation. coolcash.ca is part of a broader ecosystem of online lending platforms, each with its own terms, conditions, and levels of transparency. Users should exercise due diligence and compare options to ensure they are making informed decisions that align with their financial circumstances. The accessibility and convenience of online lending can be appealing, but understanding the full implications of borrowing through these platforms is crucial.

ALL YOU NEED TO KNOW AND HOW IT WORKS

coolcash.ca acts as an intermediary between borrowers and lenders in the short-term loan market. Users typically complete an online application providing personal and financial information. coolcash.ca then uses this information to connect the applicant with potential lenders within its network. Once a lender approves the application, the loan terms, including interest rates, repayment schedules, and fees, are presented to the borrower. If the borrower agrees to the terms, the loan is disbursed, usually via electronic transfer to the borrower's bank account. Repayment is typically structured as a single payment on the borrower's next payday or in installments. The platform's ease of use and speed of access are key features, enabling users to quickly secure funds for urgent needs. However, it is vital for borrowers to thoroughly review the loan agreement and understand the total cost of borrowing before committing to a loan.

What Makes coolcash.ca Stand Out?

- Convenient online application process

- Rapid connection to a network of lenders

- Quick disbursement of funds

- Accessibility for individuals with limited credit history

- Clear presentation of loan terms (interest rates, fees, repayment schedule) (in theory)

How to Maximize Your Experience on coolcash.ca

- Carefully compare offers from multiple lenders.

- Thoroughly review all loan terms and conditions before accepting any offer.

- Understand the full cost of borrowing, including interest rates and fees.

- Ensure you have a clear repayment plan to avoid late fees and penalties.

- Consider alternative financial solutions before resorting to a payday loan.

Why Trust coolcash.ca?

Trusting any lending platform requires careful consideration. coolcash.ca presents itself as a facilitator, connecting borrowers with lenders. While the platform may offer convenience, users should verify the credibility and reputation of the lenders within coolcash.ca's network. Look for transparent disclosures of interest rates, fees, and repayment terms. Check for independent reviews and ratings of the lenders to assess their reliability and customer service. Due diligence is crucial to ensure you are dealing with reputable lenders and avoid potential scams or predatory lending practices. coolcash.ca's trustworthiness ultimately depends on the lenders it connects users with and the transparency of the loan terms offered.

FAQs

- What types of loans does coolcash.ca facilitate?

Answer: coolcash.ca typically facilitates short-term loans, such as payday loans and installment loans. - What are the typical interest rates and fees associated with loans obtained through coolcash.ca?

Answer: Interest rates and fees can vary significantly depending on the lender and the borrower's creditworthiness. It is crucial to carefully review the loan agreement to understand the total cost of borrowing. - How quickly can I receive funds after applying through coolcash.ca?

Answer: Funds can often be disbursed within 24-48 hours of approval, but the exact timing may vary depending on the lender.

SUMMARY

coolcash.ca provides a platform for individuals to access short-term loans by connecting them with a network of lenders. While the platform offers convenience and speed, users must exercise caution and conduct thorough due diligence to ensure they are dealing with reputable lenders and understand the full cost of borrowing. Comparing offers, reviewing loan terms carefully, and having a clear repayment plan are essential steps to maximizing your experience and avoiding potential financial pitfalls.

Given these insights, thorough research and caution are advised before engaging with coolcash.ca.

Questions to Guide Your Review

- What has been your experience with coolcash.ca's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does coolcash.ca compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback