INTRO

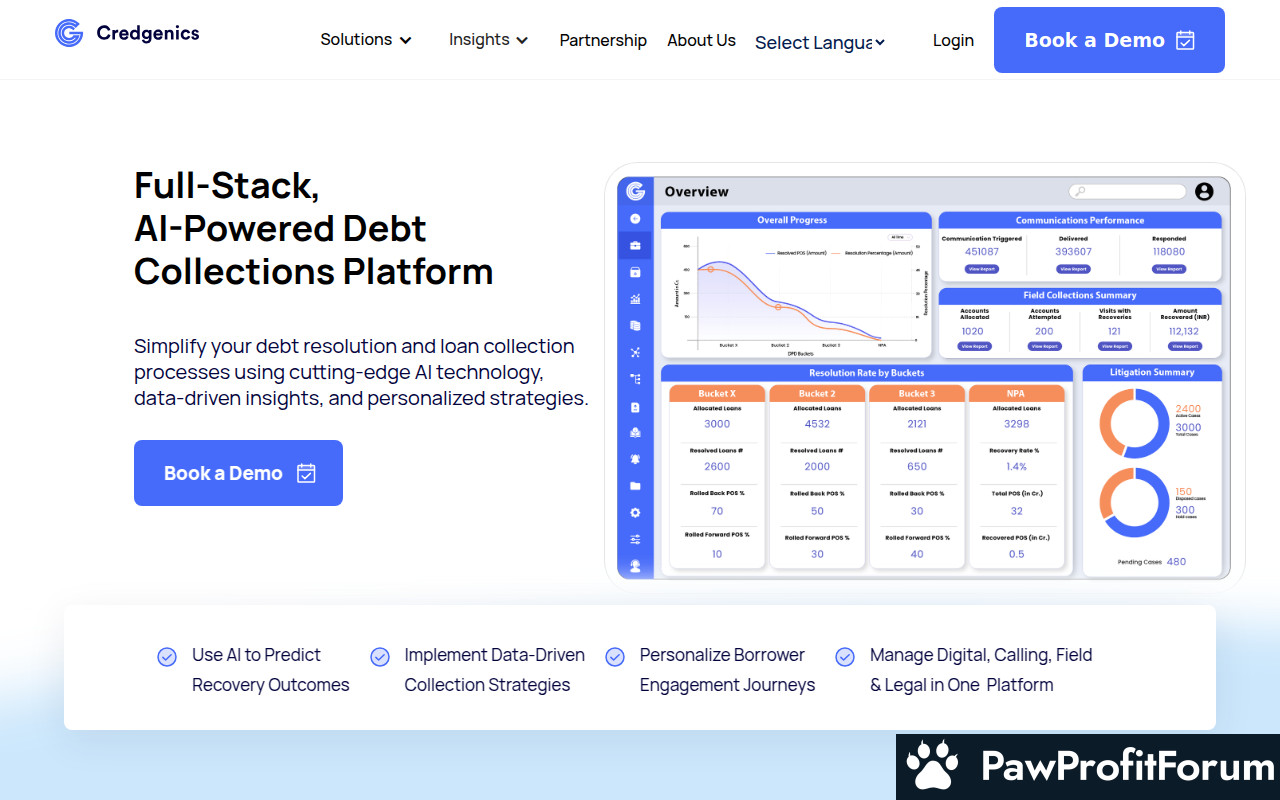

Credgenics is a technology company specializing in debt resolution and loan recovery solutions for financial institutions. It provides an end-to-end debt recovery platform designed to streamline and optimize the debt resolution process. Credgenics aims to improve efficiency, reduce non-performing assets (NPAs), and enhance the overall recovery rates for banks, NBFCs, and other lending organizations.

All You Need to Know and How it Works

Credgenics offers a comprehensive platform that integrates various stages of the debt recovery lifecycle. This includes early warning systems to identify potential defaults, digital collections, legal automation, and field collections management. The platform leverages data analytics, machine learning, and automation to improve decision-making and recovery strategies. By digitizing and automating key processes, Credgenics helps financial institutions reduce operational costs, improve compliance, and achieve better recovery outcomes.

What Makes Credgenics Stand Out?

How to Maximize Your Experience on Credgenics

Why Trust Credgenics?

Credgenics has established itself as a reputable provider of debt resolution solutions. The company works with numerous leading banks and financial institutions. Their platform is built on robust technology and complies with industry standards and regulations. Credgenics also provides transparent reporting and analytics to ensure accountability and trust.

FAQs

SUMMARY

Credgenics provides a comprehensive debt resolution platform designed to help financial institutions streamline and optimize their debt recovery processes. With its focus on data analytics, automation, and compliance, Credgenics aims to improve efficiency, reduce NPAs, and enhance recovery rates.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

Credgenics is a technology company specializing in debt resolution and loan recovery solutions for financial institutions. It provides an end-to-end debt recovery platform designed to streamline and optimize the debt resolution process. Credgenics aims to improve efficiency, reduce non-performing assets (NPAs), and enhance the overall recovery rates for banks, NBFCs, and other lending organizations.

All You Need to Know and How it Works

Credgenics offers a comprehensive platform that integrates various stages of the debt recovery lifecycle. This includes early warning systems to identify potential defaults, digital collections, legal automation, and field collections management. The platform leverages data analytics, machine learning, and automation to improve decision-making and recovery strategies. By digitizing and automating key processes, Credgenics helps financial institutions reduce operational costs, improve compliance, and achieve better recovery outcomes.

What Makes Credgenics Stand Out?

- End-to-end debt recovery platform

- Integration of data analytics and machine learning

- Automation of key debt recovery processes

- Improved compliance

- Enhanced recovery rates

- User-friendly and customizable interface

How to Maximize Your Experience on Credgenics

- Utilize early warning systems for proactive debt management.

- Leverage data analytics to identify high-risk accounts.

- Automate routine tasks to improve efficiency.

- Integrate with existing CRM and banking systems.

- Regularly monitor performance metrics to optimize strategies.

- Take advantage of training resources and support.

Why Trust Credgenics?

Credgenics has established itself as a reputable provider of debt resolution solutions. The company works with numerous leading banks and financial institutions. Their platform is built on robust technology and complies with industry standards and regulations. Credgenics also provides transparent reporting and analytics to ensure accountability and trust.

FAQs

- What types of financial institutions does Credgenics serve?

Credgenics serves banks, non-banking financial companies (NBFCs), and other lending organizations. - How does Credgenics improve debt recovery rates?

By leveraging data analytics, machine learning, and automation, Credgenics optimizes debt recovery strategies and processes. - Is Credgenics compliant with industry regulations?

Yes, Credgenics complies with relevant industry standards and regulations to ensure data security and compliance.

SUMMARY

Credgenics provides a comprehensive debt resolution platform designed to help financial institutions streamline and optimize their debt recovery processes. With its focus on data analytics, automation, and compliance, Credgenics aims to improve efficiency, reduce NPAs, and enhance recovery rates.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback