INTRO

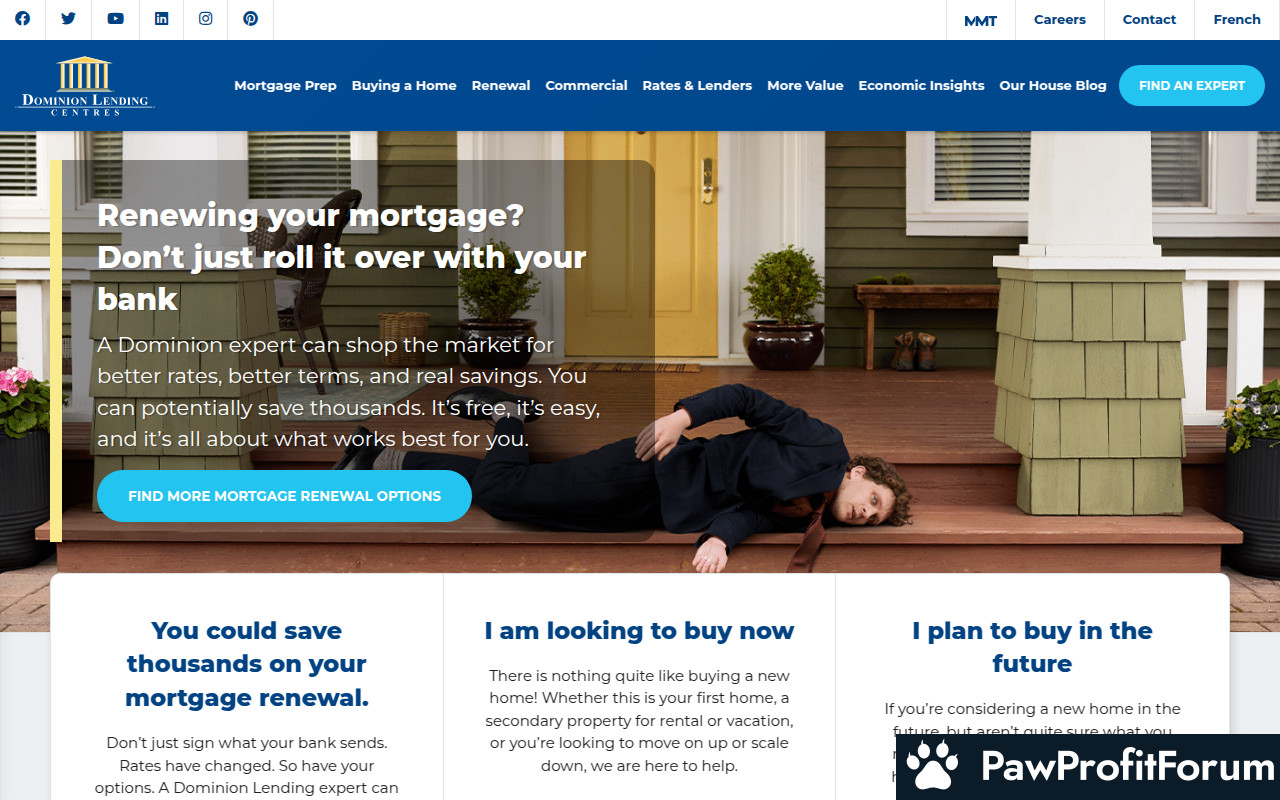

Dominion Lending Centres is a prominent name in the Canadian mortgage industry, operating as a national network of mortgage professionals. They connect borrowers with a wide range of lenders, providing access to various mortgage products and solutions. Their network includes franchises and independent mortgage brokers across Canada.

All You Need to Know and How it Works

Dominion Lending Centres functions as a brokerage, meaning its agents work with multiple lenders (banks, credit unions, and trust companies) to find the best mortgage rates and terms for their clients. Borrowers complete an application with a Dominion Lending Centres agent, who then submits it to several lenders. The agent presents the client with the available options, helping them choose the most suitable mortgage. DLC also provides resources and tools for mortgage education and planning.

What Makes Dominion Lending Centres Stand Out?

How to Maximize Your Experience on Dominion Lending Centres

Why Trust Dominion Lending Centres?

Dominion Lending Centres is a well-established brand in the Canadian mortgage industry with a large network of experienced professionals. They are subject to regulations and oversight, ensuring a level of accountability. However, it's crucial to do your own due diligence and research the specific agent you work with to ensure they are reputable and qualified.

FAQs

SUMMARY

Dominion Lending Centres offers a convenient way for Canadian borrowers to compare mortgage options from various lenders and receive expert advice. By leveraging their extensive network and resources, borrowers can potentially save time and money while finding the right mortgage solution. However, due diligence and careful consideration of individual agent qualifications are essential.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

Dominion Lending Centres is a prominent name in the Canadian mortgage industry, operating as a national network of mortgage professionals. They connect borrowers with a wide range of lenders, providing access to various mortgage products and solutions. Their network includes franchises and independent mortgage brokers across Canada.

All You Need to Know and How it Works

Dominion Lending Centres functions as a brokerage, meaning its agents work with multiple lenders (banks, credit unions, and trust companies) to find the best mortgage rates and terms for their clients. Borrowers complete an application with a Dominion Lending Centres agent, who then submits it to several lenders. The agent presents the client with the available options, helping them choose the most suitable mortgage. DLC also provides resources and tools for mortgage education and planning.

What Makes Dominion Lending Centres Stand Out?

- Extensive Lender Network: Access to a wide variety of mortgage products from different lenders.

- Expert Advice: Guidance from experienced mortgage professionals.

- Convenience: Simplifies the mortgage shopping process by comparing options from multiple lenders.

- Educational Resources: Tools and information to help borrowers make informed decisions.

- National Presence: Service available across Canada.

How to Maximize Your Experience on Dominion Lending Centres

- Prepare Your Documents: Gather necessary financial documents (pay stubs, tax returns, etc.) beforehand.

- Be Clear About Your Needs: Communicate your financial goals and preferences to your agent.

- Compare Options Carefully: Review the different mortgage options presented by your agent and ask questions.

- Utilize Online Resources: Take advantage of the calculators and educational materials on their website.

Why Trust Dominion Lending Centres?

Dominion Lending Centres is a well-established brand in the Canadian mortgage industry with a large network of experienced professionals. They are subject to regulations and oversight, ensuring a level of accountability. However, it's crucial to do your own due diligence and research the specific agent you work with to ensure they are reputable and qualified.

FAQs

- How does Dominion Lending Centres make money? Dominion Lending Centres agents are typically paid a commission by the lender when a mortgage is successfully secured for a client.

- What types of mortgages can I get through Dominion Lending Centres? Dominion Lending Centres offers a wide range of mortgage products, including first-time homebuyer mortgages, refinance mortgages, investment property mortgages, and more.

- Is it better to go through a mortgage broker or directly to a bank? Both have advantages. A broker can provide access to multiple lenders and potentially find a better rate, while going directly to a bank may offer more personalized service or loyalty benefits.

SUMMARY

Dominion Lending Centres offers a convenient way for Canadian borrowers to compare mortgage options from various lenders and receive expert advice. By leveraging their extensive network and resources, borrowers can potentially save time and money while finding the right mortgage solution. However, due diligence and careful consideration of individual agent qualifications are essential.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback