INTRO

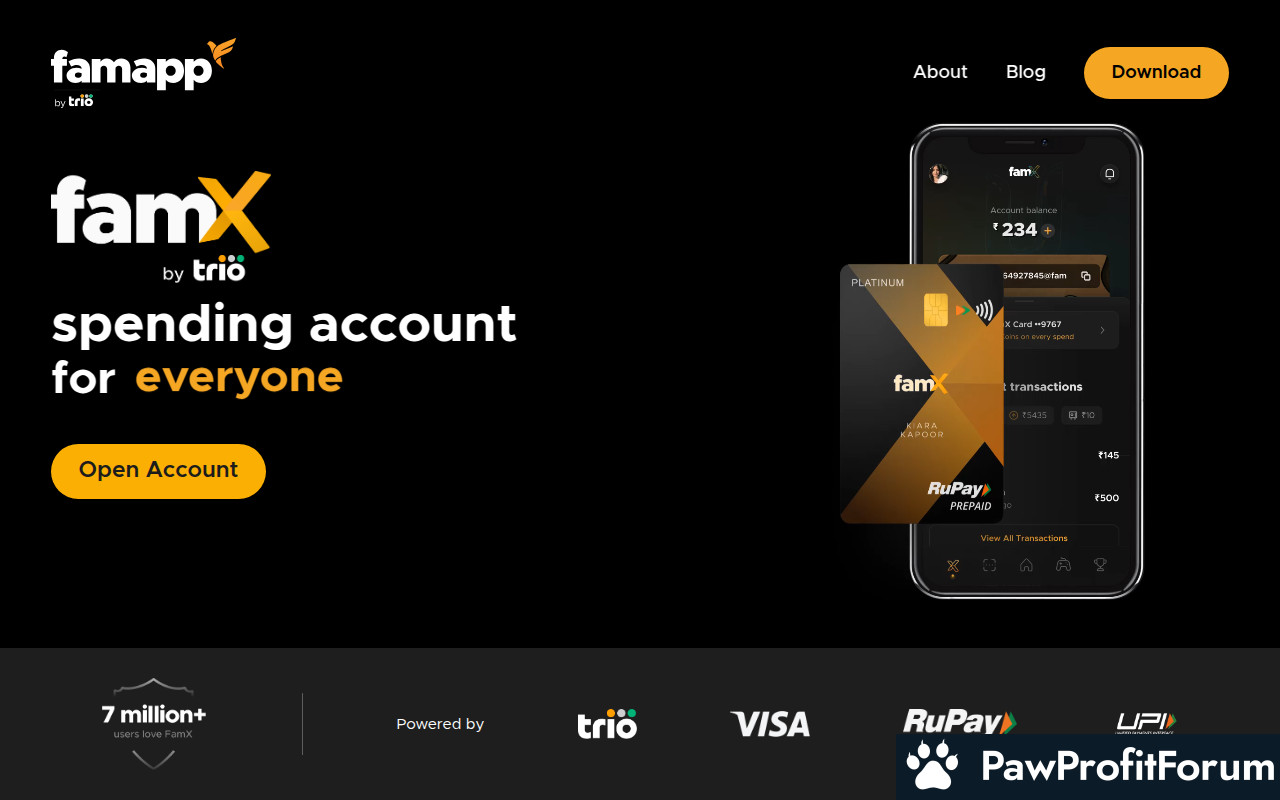

FamPay is an Indian fintech company targeting teenagers with its unique banking and payment solutions. Operating within the Non-Bank Financial Service sector, it provides financial services akin to a Financial Institution, and even aspects of a Bank, tailored specifically for young users. FamPay aims to introduce teenagers to the world of digital finance early, offering them a safe and controlled environment to manage their money. It provides a platform where teenagers can make online and offline payments, fostering financial literacy and responsibility from a young age. FamPay also provides Alternative Financial Service, and that's makes it unique.

All You Need to Know and How it Works

FamPay provides teenagers with their own UPI (Unified Payments Interface) ID and a card, enabling them to make transactions without needing a bank account. Parents can load money into the FamPay account, which teenagers can then use for various payments. The platform also includes features for tracking expenses and setting spending limits, allowing parents to guide their children's financial habits. FamPay partners with banks to provide these services, ensuring secure and regulated transactions.

What Makes FamPay Stand Out?

How to Maximize Your Experience on FamPay

Why Trust FamPay?

FamPay partners with reputable banks and adheres to regulatory standards, ensuring the safety and security of users' funds. The platform also provides parental control features, allowing parents to monitor and manage their children's financial activities. With a focus on transparency and security, FamPay aims to build trust with its users and their parents.

FAQs

SUMMARY

FamPay is a fintech platform designed to introduce teenagers to the world of digital finance. By providing them with their own UPI ID and card, along with parental control features, FamPay aims to foster financial literacy and responsibility from a young age. With its secure and regulated transactions, FamPay offers a safe and controlled environment for teenagers to manage their money.

Given these insights, thorough research and caution are advised before engaging with FamPay.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

FamPay is an Indian fintech company targeting teenagers with its unique banking and payment solutions. Operating within the Non-Bank Financial Service sector, it provides financial services akin to a Financial Institution, and even aspects of a Bank, tailored specifically for young users. FamPay aims to introduce teenagers to the world of digital finance early, offering them a safe and controlled environment to manage their money. It provides a platform where teenagers can make online and offline payments, fostering financial literacy and responsibility from a young age. FamPay also provides Alternative Financial Service, and that's makes it unique.

All You Need to Know and How it Works

FamPay provides teenagers with their own UPI (Unified Payments Interface) ID and a card, enabling them to make transactions without needing a bank account. Parents can load money into the FamPay account, which teenagers can then use for various payments. The platform also includes features for tracking expenses and setting spending limits, allowing parents to guide their children's financial habits. FamPay partners with banks to provide these services, ensuring secure and regulated transactions.

What Makes FamPay Stand Out?

- Targeted at Teenagers: Specifically designed for young users, addressing their unique financial needs.

- UPI and Card Access: Provides teenagers with their own UPI ID and card for easy transactions.

- Parental Control: Allows parents to monitor and manage their children's spending.

- Financial Literacy: Promotes early financial education and responsibility.

- Secure Transactions: Ensures secure and regulated transactions through bank partnerships.

How to Maximize Your Experience on FamPay

- Set Spending Limits: Utilize the spending limit feature to manage expenses effectively.

- Track Transactions: Regularly monitor transactions to understand spending habits.

- Explore Educational Resources: Take advantage of the financial literacy resources available on the platform.

- Engage with Customer Support: Reach out to customer support for any queries or assistance.

Why Trust FamPay?

FamPay partners with reputable banks and adheres to regulatory standards, ensuring the safety and security of users' funds. The platform also provides parental control features, allowing parents to monitor and manage their children's financial activities. With a focus on transparency and security, FamPay aims to build trust with its users and their parents.

FAQs

- Is FamPay safe to use?

Yes, FamPay partners with reputable banks and adheres to regulatory standards to ensure the safety and security of users' funds. - Can parents monitor their children's spending on FamPay?

Yes, FamPay provides parental control features that allow parents to monitor and manage their children's financial activities. - What age group is FamPay designed for?

FamPay is specifically designed for teenagers, typically between the ages of 13 and 19.

SUMMARY

FamPay is a fintech platform designed to introduce teenagers to the world of digital finance. By providing them with their own UPI ID and card, along with parental control features, FamPay aims to foster financial literacy and responsibility from a young age. With its secure and regulated transactions, FamPay offers a safe and controlled environment for teenagers to manage their money.

Given these insights, thorough research and caution are advised before engaging with FamPay.

Questions to Guide Your Review

- What has been your experience with FamPay's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does FamPay compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback