Lido for Polygon is a liquid staking solution for MATIC backed by industry-leading staking providers. Lido lets users earn MATIC staking rewards without needing to maintain infrastructure and enables them to trade staked positions, as well as participate in on-chain decentralized finance with their staked assets. Lido for Polygon gives users options to:

The governance of Lido Staked Matic is managed by the Lido DAO, which utilizes the LDO token to make critical protocol decisions, including fee structures that fund governance and upgrades. stMATIC, an ERC20 token, is non-rebasable, meaning the token count in a user's wallet remains constant, while its value fluctuates based on the protocol's MATIC holdings.

stMATIC can be bridged to the Polygon network and is widely supported by various decentralized finance (DeFi) applications, enabling users to trade staked positions and engage in on-chain activities. The withdrawal process for stMATIC involves a waiting period of approximately 3-4 days. Despite recent upgrades to the POL token on Polygon, Lido's operations remain unaffected, ensuring stability and continuity for its users.

The Polygon blockchain, upon which Lido Staked Matic operates, is a layer-2 scaling solution for Ethereum. It enhances the Ethereum network by providing faster and cheaper transactions, which is crucial for the scalability of decentralized applications (dApps). Polygon achieves this through a proof-of-stake (PoS) consensus mechanism, which is both energy-efficient and secure. In this system, validators are chosen to create new blocks and confirm transactions based on the number of tokens they hold and are willing to "stake" as collateral. This staking process helps prevent attacks from bad actors, as any malicious behavior could result in the loss of their staked tokens.

The security of the Polygon network is further bolstered by its use of a multi-layered architecture. This includes a layer for executing smart contracts and another for ensuring security through checkpoints and fraud proofs. These layers work together to ensure that the network remains robust against potential threats, providing a secure environment for Lido Staked Matic to operate.

Lido's liquid staking solution is particularly innovative because it allows users to trade their staked positions and participate in decentralized finance (DeFi) activities. The stMATIC token, an ERC20 token, represents a user's share of the total supply of MATIC tokens within the Lido-on-Polygon system. Unlike traditional staking, where tokens are locked and inaccessible, stMATIC can be used in various DeFi applications, providing users with flexibility and additional earning opportunities.

The governance of Lido on Polygon is managed through the Lido DAO, with the LDO token granting governance rights. This decentralized governance model ensures that decisions regarding the protocol are made collectively by the community, promoting transparency and inclusivity. The fees collected by Lido are used for governance and decision-making within the DAO, ensuring the sustainability and development of the platform.

Users can bridge their stMATIC tokens to the Polygon network, allowing them to leverage the benefits of both the Ethereum and Polygon ecosystems. This interoperability is a key feature, enabling users to engage with a wide range of DeFi platforms and services. Additionally, the non-rebasable nature of stMATIC means that while the number of tokens in a user's wallet remains constant, the value of these tokens can change over time as the amount of MATIC tokens within the protocol fluctuates.

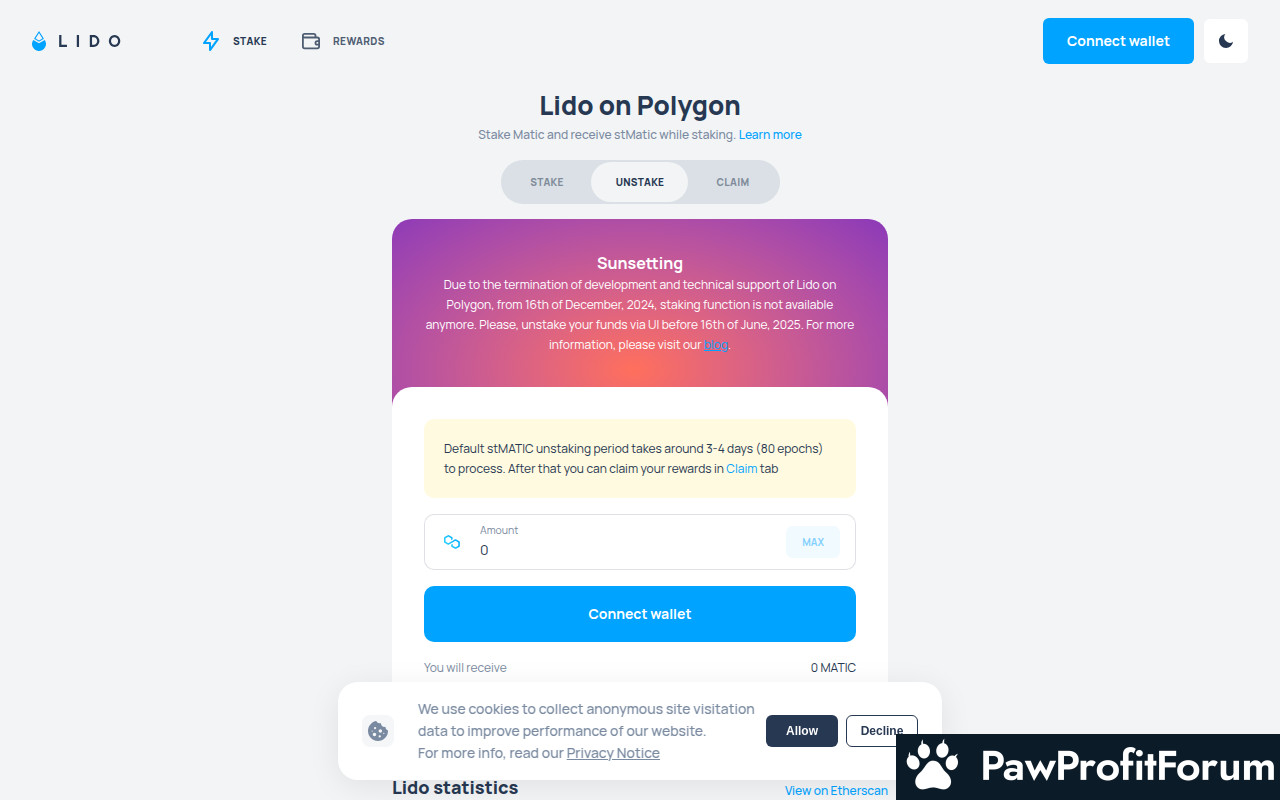

A unique aspect of Lido Staked Matic is the withdrawal process. When users wish to convert their stMATIC back to MATIC, there is a waiting period of approximately 3-4 days. This delay is a result of the underlying mechanics of the staking and unstaking process on the Polygon network, ensuring that the system remains secure and efficient.

The recent upgrade to the POL token on Polygon does not impact the functionality of Lido on Polygon, highlighting the adaptability and resilience of the platform. This ensures that users can continue to enjoy the benefits of liquid staking and DeFi participation without disruption.

One of the primary applications of stMATIC is its use in decentralized finance (DeFi). Users can leverage their stMATIC tokens in various DeFi protocols on the Polygon network, enabling them to earn additional yields or participate in liquidity pools. This flexibility allows users to maximize their returns while maintaining the liquidity of their staked assets.

Moreover, stMATIC can be traded on secondary markets, providing users with the ability to liquidate their staked positions if needed. This feature is particularly beneficial for those who wish to access their funds without waiting for the typical unstaking period, which is around 3-4 days.

Lido's platform also enhances the user experience by offering a straightforward interface for managing staked assets. Users can easily stake their MATIC tokens and manage their stMATIC holdings with just a few clicks. Additionally, Lido is exploring options to allow deposits with both POL and MATIC tokens, further broadening the accessibility of its staking services.

The governance of Lido's liquid staking protocols is managed by the Lido DAO, where the LDO token holders have a say in key decisions and protocol upgrades. This decentralized governance structure ensures that the platform evolves in a way that aligns with the interests of its community.

In essence, Lido Staked Matic provides a comprehensive solution for those looking to earn passive income through staking while maintaining the flexibility to engage in DeFi activities and trade staked assets.

The journey of Lido Staked Matic began with the launch of Lido on Polygon. This event marked a pivotal moment, enabling users to stake MATIC tokens in a decentralized and secure manner. By staking MATIC, users receive stMATIC, an ERC20 token that reflects their share of the total MATIC supply within the PoLido system. Unlike rebasing tokens, stMATIC maintains a constant token count in users' wallets, with its value fluctuating based on the MATIC within the protocol.

The integration of stMATIC with various decentralized finance (DeFi) applications further expanded its utility. This integration allowed users to leverage their staked assets across multiple DeFi platforms, enhancing liquidity and enabling trading of staked positions. The ability to use stMATIC on secondary markets provided additional flexibility and opportunities for users to maximize their staking rewards.

Governance of the Lido protocol is managed by the Lido DAO, which is controlled by the LDO token. This decentralized autonomous organization is responsible for making decisions on key parameters and protocol upgrades. The fees collected by Lido are allocated towards governance and further protocol enhancements, ensuring the system's sustainability and growth.

A notable feature of Lido on Polygon is the withdrawal process. Users who wish to unstake their MATIC must undergo a waiting period of 3-4 days before they can claim their tokens. This period is an essential aspect of the protocol's design, balancing security and liquidity.

The upgrade to the POL token was another significant development, although it did not directly impact Lido on Polygon. This upgrade was part of a broader strategy to enhance the overall functionality and interoperability of the Polygon network, indirectly benefiting stMATIC users by improving the underlying infrastructure.

At the time of writing, Lido Staked Matic continues to gain traction, with an estimated reward rate of 4.41%. This growth reflects the increasing popularity of liquid staking solutions and the demand for decentralized finance options that offer both security and flexibility. As the ecosystem evolves, Lido Staked Matic remains a key player in the landscape of Polygon-based DeFi applications.

- Stake their MATIC tokens in a decentralized and secure way

- Use their stMATIC on the secondary market

- Do all of the above simply and easily with a click of a button on the UI

What is Lido Staked Matic?

Lido Staked Matic (stMATIC) revolutionizes the staking landscape on the Polygon network by offering a liquid staking solution for MATIC tokens. This decentralized platform allows users to stake MATIC without the hassle of maintaining infrastructure, providing a seamless entry into the world of staking rewards. By delegating MATIC tokens to Polygon validators, users receive stMATIC tokens, which represent their share of the total MATIC supply within the Lido-on-Polygon system.The governance of Lido Staked Matic is managed by the Lido DAO, which utilizes the LDO token to make critical protocol decisions, including fee structures that fund governance and upgrades. stMATIC, an ERC20 token, is non-rebasable, meaning the token count in a user's wallet remains constant, while its value fluctuates based on the protocol's MATIC holdings.

stMATIC can be bridged to the Polygon network and is widely supported by various decentralized finance (DeFi) applications, enabling users to trade staked positions and engage in on-chain activities. The withdrawal process for stMATIC involves a waiting period of approximately 3-4 days. Despite recent upgrades to the POL token on Polygon, Lido's operations remain unaffected, ensuring stability and continuity for its users.

What is the technology behind Lido Staked Matic?

Lido Staked Matic (stMATIC) represents a fascinating intersection of blockchain technology and decentralized finance, offering a liquid staking solution on the Polygon network. At its core, Lido on Polygon allows users to stake their MATIC tokens without the need to lock them up or manage complex staking infrastructure. This is achieved through a decentralized autonomous organization (DAO)-controlled smart contract, which stakes tokens using a selection of industry-leading staking providers. This setup not only simplifies the staking process but also enables users to earn rewards while maintaining liquidity.The Polygon blockchain, upon which Lido Staked Matic operates, is a layer-2 scaling solution for Ethereum. It enhances the Ethereum network by providing faster and cheaper transactions, which is crucial for the scalability of decentralized applications (dApps). Polygon achieves this through a proof-of-stake (PoS) consensus mechanism, which is both energy-efficient and secure. In this system, validators are chosen to create new blocks and confirm transactions based on the number of tokens they hold and are willing to "stake" as collateral. This staking process helps prevent attacks from bad actors, as any malicious behavior could result in the loss of their staked tokens.

The security of the Polygon network is further bolstered by its use of a multi-layered architecture. This includes a layer for executing smart contracts and another for ensuring security through checkpoints and fraud proofs. These layers work together to ensure that the network remains robust against potential threats, providing a secure environment for Lido Staked Matic to operate.

Lido's liquid staking solution is particularly innovative because it allows users to trade their staked positions and participate in decentralized finance (DeFi) activities. The stMATIC token, an ERC20 token, represents a user's share of the total supply of MATIC tokens within the Lido-on-Polygon system. Unlike traditional staking, where tokens are locked and inaccessible, stMATIC can be used in various DeFi applications, providing users with flexibility and additional earning opportunities.

The governance of Lido on Polygon is managed through the Lido DAO, with the LDO token granting governance rights. This decentralized governance model ensures that decisions regarding the protocol are made collectively by the community, promoting transparency and inclusivity. The fees collected by Lido are used for governance and decision-making within the DAO, ensuring the sustainability and development of the platform.

Users can bridge their stMATIC tokens to the Polygon network, allowing them to leverage the benefits of both the Ethereum and Polygon ecosystems. This interoperability is a key feature, enabling users to engage with a wide range of DeFi platforms and services. Additionally, the non-rebasable nature of stMATIC means that while the number of tokens in a user's wallet remains constant, the value of these tokens can change over time as the amount of MATIC tokens within the protocol fluctuates.

A unique aspect of Lido Staked Matic is the withdrawal process. When users wish to convert their stMATIC back to MATIC, there is a waiting period of approximately 3-4 days. This delay is a result of the underlying mechanics of the staking and unstaking process on the Polygon network, ensuring that the system remains secure and efficient.

The recent upgrade to the POL token on Polygon does not impact the functionality of Lido on Polygon, highlighting the adaptability and resilience of the platform. This ensures that users can continue to enjoy the benefits of liquid staking and DeFi participation without disruption.

What are the real-world applications of Lido Staked Matic?

Lido Staked Matic (stMATIC) offers a unique approach to staking on the Polygon network, providing users with a liquid staking solution. This allows individuals to earn staking rewards without the need to lock up their MATIC tokens or manage complex staking infrastructure. By staking MATIC through Lido, users receive stMATIC, an ERC20 token that represents their share of the total staked MATIC within the Lido-on-Polygon system.One of the primary applications of stMATIC is its use in decentralized finance (DeFi). Users can leverage their stMATIC tokens in various DeFi protocols on the Polygon network, enabling them to earn additional yields or participate in liquidity pools. This flexibility allows users to maximize their returns while maintaining the liquidity of their staked assets.

Moreover, stMATIC can be traded on secondary markets, providing users with the ability to liquidate their staked positions if needed. This feature is particularly beneficial for those who wish to access their funds without waiting for the typical unstaking period, which is around 3-4 days.

Lido's platform also enhances the user experience by offering a straightforward interface for managing staked assets. Users can easily stake their MATIC tokens and manage their stMATIC holdings with just a few clicks. Additionally, Lido is exploring options to allow deposits with both POL and MATIC tokens, further broadening the accessibility of its staking services.

The governance of Lido's liquid staking protocols is managed by the Lido DAO, where the LDO token holders have a say in key decisions and protocol upgrades. This decentralized governance structure ensures that the platform evolves in a way that aligns with the interests of its community.

In essence, Lido Staked Matic provides a comprehensive solution for those looking to earn passive income through staking while maintaining the flexibility to engage in DeFi activities and trade staked assets.

What key events have there been for Lido Staked Matic?

Lido Staked Matic (stMATIC) represents a significant innovation in the realm of decentralized finance on the Polygon network. This liquid staking solution allows users to stake their MATIC tokens and receive stMATIC in return, facilitating participation in on-chain decentralized finance without the need for maintaining complex infrastructure.The journey of Lido Staked Matic began with the launch of Lido on Polygon. This event marked a pivotal moment, enabling users to stake MATIC tokens in a decentralized and secure manner. By staking MATIC, users receive stMATIC, an ERC20 token that reflects their share of the total MATIC supply within the PoLido system. Unlike rebasing tokens, stMATIC maintains a constant token count in users' wallets, with its value fluctuating based on the MATIC within the protocol.

The integration of stMATIC with various decentralized finance (DeFi) applications further expanded its utility. This integration allowed users to leverage their staked assets across multiple DeFi platforms, enhancing liquidity and enabling trading of staked positions. The ability to use stMATIC on secondary markets provided additional flexibility and opportunities for users to maximize their staking rewards.

Governance of the Lido protocol is managed by the Lido DAO, which is controlled by the LDO token. This decentralized autonomous organization is responsible for making decisions on key parameters and protocol upgrades. The fees collected by Lido are allocated towards governance and further protocol enhancements, ensuring the system's sustainability and growth.

A notable feature of Lido on Polygon is the withdrawal process. Users who wish to unstake their MATIC must undergo a waiting period of 3-4 days before they can claim their tokens. This period is an essential aspect of the protocol's design, balancing security and liquidity.

The upgrade to the POL token was another significant development, although it did not directly impact Lido on Polygon. This upgrade was part of a broader strategy to enhance the overall functionality and interoperability of the Polygon network, indirectly benefiting stMATIC users by improving the underlying infrastructure.

At the time of writing, Lido Staked Matic continues to gain traction, with an estimated reward rate of 4.41%. This growth reflects the increasing popularity of liquid staking solutions and the demand for decentralized finance options that offer both security and flexibility. As the ecosystem evolves, Lido Staked Matic remains a key player in the landscape of Polygon-based DeFi applications.

Who are the founders of Lido Staked Matic?

Lido Staked Matic (stMATIC) emerges as a collaborative effort between the Lido DAO and the Polygon team, offering a liquid staking solution for MATIC. At the heart of this initiative are Vasilii Shapovalov and Konstantin Lomashuk, who play pivotal roles in its development. Lido DAO, known for its expertise in decentralized finance, partners with Polygon to provide users with the ability to stake MATIC tokens securely and participate in decentralized finance. This partnership allows users to earn staking rewards without managing infrastructure, enhancing the accessibility and utility of stMATIC in the crypto ecosystem.| Website | polygon.lido.fi/ |

| Socials | twitter.com/lidofinance |

| Socials | github.com/Shard-Labs/PoLido |

| Socials | t.me/lidofinance |

| Contracts | 0x9ee9...fd8599 |

| Explorers | etherscan.io/token/0x9ee91F9f426fA633d227f7a9b000E28b9dfd8599 |