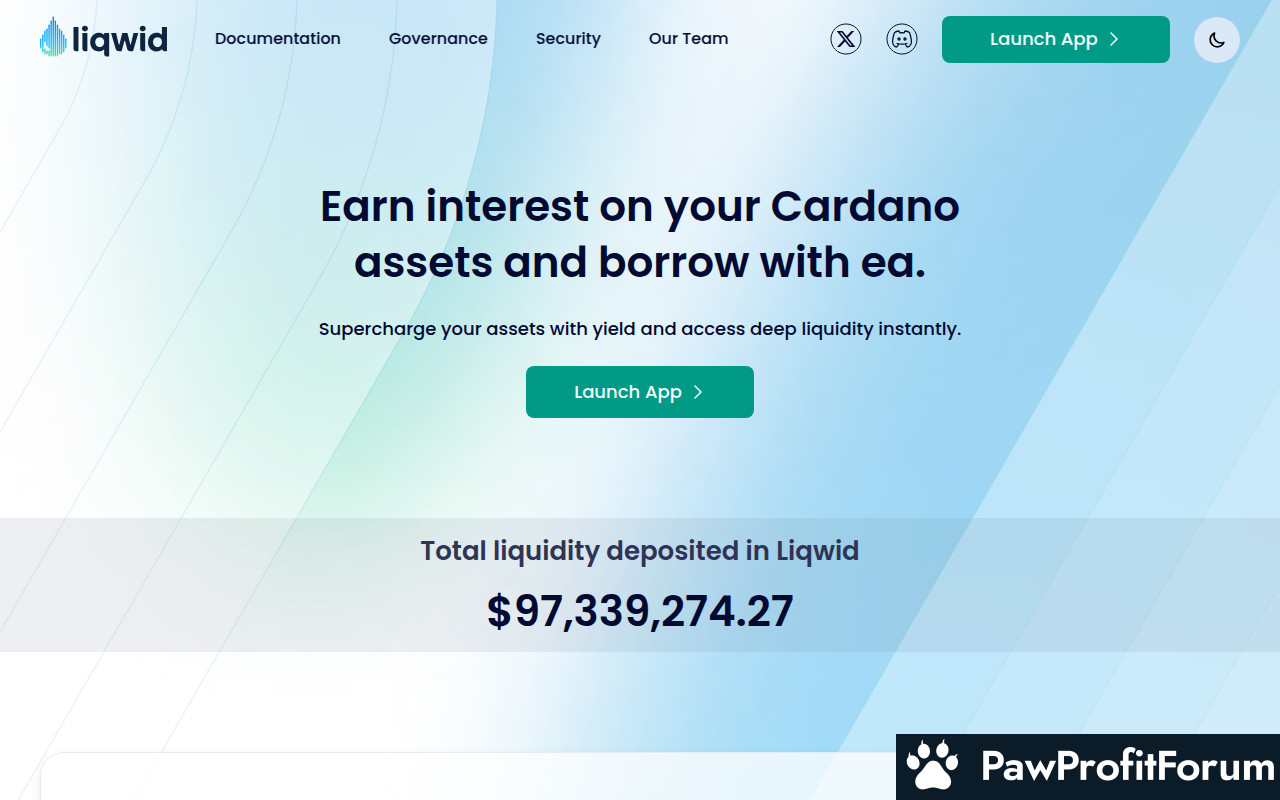

Liqwid is an open source, algorithmic and non-custodial interest rate protocol built for lenders, borrowers and developers. Users can securely earn interest on deposits and borrow assets with ease while earning yield on ADA from multiple yield streams.

The protocol allows users to earn interest on deposits and borrow assets seamlessly. This is achieved through a decentralized liquidity market that ensures fast and affordable transactions. The team behind Liqwid Finance, including CEO Dewayne Cameron, co-founder Florian Volery, and CTO Emily Martins, brings together expertise in Haskell and TypeScript to drive the project's development.

Liqwid Finance's cryptocurrency, LQ, plays a crucial role within the ecosystem. It facilitates various financial activities on the platform, enhancing liquidity and enabling users to participate in governance. Additionally, the recent launch of the Cardano Staking ETP, CASL, on the SIX Swiss Exchange, marks a significant milestone, expanding the reach and utility of the protocol.

Built on the robust Cardano blockchain, Liqwid Finance ensures security and scalability. Users benefit from multiple yield streams on ADA, maximizing their returns while maintaining control over their assets. The protocol's non-custodial nature means that users retain ownership of their funds, reducing the risks associated with centralized financial systems.

The Liqwid Protocol is a non-custodial liquidity market protocol, meaning it does not hold users' funds directly. Instead, it facilitates secure transactions between lenders and borrowers. This setup ensures that users maintain control over their assets, reducing the risk of centralized points of failure. The protocol is open source and algorithmic, designed to provide transparent and efficient liquidity solutions. This transparency is crucial in the DeFi space, where trust is paramount.

Cardano's blockchain employs a proof-of-stake (PoS) consensus mechanism, which is instrumental in preventing attacks from bad actors. In a PoS system, validators are chosen to create new blocks and confirm transactions based on the number of coins they hold and are willing to "stake" as collateral. This method is energy-efficient compared to the proof-of-work (PoW) systems used by other blockchains like Bitcoin. Additionally, it makes it economically unfeasible for malicious entities to gain control of the network, as they would need to acquire a significant portion of the total staked coins.

Liqwid Finance leverages Cardano's smart contract capabilities to automate the lending and borrowing processes. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They enable complex financial transactions to occur without the need for intermediaries, ensuring that the terms are met precisely as programmed. This automation reduces the potential for human error and increases the efficiency of financial operations.

Another critical aspect of Liqwid Finance is its focus on providing multiple yield streams for users. By depositing assets into the protocol, users can earn interest on their holdings. This interest is generated from the borrowing activities within the platform, where borrowers pay interest on the assets they borrow. The protocol's algorithm dynamically adjusts interest rates based on supply and demand, ensuring that the rates remain competitive and reflective of market conditions.

Security is further enhanced through rigorous code audits and community governance. The open-source nature of the Liqwid Protocol allows developers from around the world to inspect and contribute to the codebase, identifying potential vulnerabilities and suggesting improvements. Community governance ensures that decisions regarding the protocol's development and operation are made democratically, with token holders having a say in the future direction of the platform.

The integration of these technologies creates a comprehensive ecosystem where users can lend, borrow, and earn interest on their assets seamlessly. The non-custodial nature of the protocol, combined with the security and efficiency of the Cardano blockchain, provides a robust framework for decentralized finance activities. This ecosystem is designed to be accessible to developers as well, offering tools and APIs to build new financial products and services on top of the Liqwid Protocol.

One of the primary real-world applications of Liqwid Finance is earning interest on Cardano assets. Users can deposit their assets into the protocol and earn interest, which is generated through various yield streams. This allows individuals to grow their holdings without actively trading or engaging in complex financial maneuvers.

Borrowing is another significant application. Users can borrow assets against their deposits, providing them with liquidity without needing to sell their holdings. This is particularly useful for those who need quick access to funds but want to retain their investment positions. The borrowing process is streamlined and efficient, leveraging the speed and low transaction costs of the Cardano blockchain.

Liqwid Finance also emphasizes community-driven onchain governance. The protocol is managed through decentralized governance, meaning that upgrades and modifications are decided by the community of LQ token holders. This democratic approach ensures that the platform evolves in a way that reflects the interests and needs of its users.

The team behind Liqwid Finance, Liqwid Labs, comprises skilled Haskell and TypeScript software engineers. They focus on developing and maintaining the protocol, although they do not control it directly. Instead, the protocol operates independently through smart contracts on the Cardano blockchain, eliminating the need for financial intermediaries or custodians.

By transforming real-world assets onto digital rails, Liqwid Finance aims to disrupt traditional finance. It offers quick and affordable lending facilities, making financial services more accessible, especially for the unbanked. This approach has the potential to empower individuals who have been excluded from traditional financial systems, providing them with new opportunities for economic participation.

The inception of Liqwid Finance marked a significant milestone when it launched on the Cardano blockchain. This launch was pivotal as it leveraged Cardano's robust infrastructure to offer a decentralized financial ecosystem. The protocol's foundation on Cardano provided it with a secure and scalable environment, essential for its growth and adoption.

The development of the Liqwid Finance team has been another cornerstone event. The team, comprising experts in blockchain technology, finance, and software development, has been instrumental in driving the protocol's innovation and expansion. Their expertise has ensured that Liqwid Finance remains at the forefront of DeFi advancements, continually enhancing its features and capabilities.

Ongoing updates and modifications to the protocol have also been crucial. These updates are designed to improve user experience, security, and functionality. For instance, enhancements to the algorithmic interest rate model have optimized the lending and borrowing processes, making them more efficient and user-friendly. Additionally, security updates have fortified the protocol against potential vulnerabilities, ensuring the safety of users' assets.

Liqwid Finance has been gaining traction and attention in the cryptocurrency market. Recent news articles have highlighted its growth and the introduction of new products. These developments have positioned Liqwid Finance as a promising player in the DeFi space, attracting a growing user base and increasing its market presence.

Despite its growth, Liqwid Finance remains a relatively small player compared to other cryptocurrencies. However, its unique value proposition and continuous innovation have set it apart, making it a noteworthy contender in the DeFi landscape. The protocol's ability to offer multiple yield streams on ADA and its commitment to decentralization and security have been key factors in its rising popularity.

The introduction of new products has further expanded Liqwid Finance's ecosystem. These products cater to the diverse needs of its users, providing them with more options to earn and manage their assets. The continuous rollout of innovative solutions has kept the protocol relevant and competitive in the fast-evolving DeFi market.

Liqwid Finance's journey has been marked by significant milestones that have shaped its trajectory in the DeFi space. From its launch on the Cardano blockchain to the development of its team and ongoing protocol updates, each event has contributed to its growth and success. The protocol's focus on security, user experience, and innovation continues to drive its expansion and adoption among cryptocurrency enthusiasts.

What is Liqwid Finance?

Liqwid Finance stands out as an innovative, open-source protocol designed for the Cardano blockchain. It operates as an algorithmic, non-custodial interest rate protocol, catering to lenders, borrowers, and developers. By leveraging decentralized, audited smart contracts, Liqwid Finance offers a transparent and efficient alternative to traditional financial systems.The protocol allows users to earn interest on deposits and borrow assets seamlessly. This is achieved through a decentralized liquidity market that ensures fast and affordable transactions. The team behind Liqwid Finance, including CEO Dewayne Cameron, co-founder Florian Volery, and CTO Emily Martins, brings together expertise in Haskell and TypeScript to drive the project's development.

Liqwid Finance's cryptocurrency, LQ, plays a crucial role within the ecosystem. It facilitates various financial activities on the platform, enhancing liquidity and enabling users to participate in governance. Additionally, the recent launch of the Cardano Staking ETP, CASL, on the SIX Swiss Exchange, marks a significant milestone, expanding the reach and utility of the protocol.

Built on the robust Cardano blockchain, Liqwid Finance ensures security and scalability. Users benefit from multiple yield streams on ADA, maximizing their returns while maintaining control over their assets. The protocol's non-custodial nature means that users retain ownership of their funds, reducing the risks associated with centralized financial systems.

What is the technology behind Liqwid Finance?

The technology behind Liqwid Finance, represented by the ticker LQ, is a fascinating blend of decentralized finance (DeFi) principles and advanced blockchain technology. At its core, Liqwid Finance operates on the Cardano blockchain, a platform known for its robust security, scalability, and sustainability. This foundation allows Liqwid Finance to offer a decentralized peer-to-peer computer service protocol known as the Liqwid Protocol.The Liqwid Protocol is a non-custodial liquidity market protocol, meaning it does not hold users' funds directly. Instead, it facilitates secure transactions between lenders and borrowers. This setup ensures that users maintain control over their assets, reducing the risk of centralized points of failure. The protocol is open source and algorithmic, designed to provide transparent and efficient liquidity solutions. This transparency is crucial in the DeFi space, where trust is paramount.

Cardano's blockchain employs a proof-of-stake (PoS) consensus mechanism, which is instrumental in preventing attacks from bad actors. In a PoS system, validators are chosen to create new blocks and confirm transactions based on the number of coins they hold and are willing to "stake" as collateral. This method is energy-efficient compared to the proof-of-work (PoW) systems used by other blockchains like Bitcoin. Additionally, it makes it economically unfeasible for malicious entities to gain control of the network, as they would need to acquire a significant portion of the total staked coins.

Liqwid Finance leverages Cardano's smart contract capabilities to automate the lending and borrowing processes. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They enable complex financial transactions to occur without the need for intermediaries, ensuring that the terms are met precisely as programmed. This automation reduces the potential for human error and increases the efficiency of financial operations.

Another critical aspect of Liqwid Finance is its focus on providing multiple yield streams for users. By depositing assets into the protocol, users can earn interest on their holdings. This interest is generated from the borrowing activities within the platform, where borrowers pay interest on the assets they borrow. The protocol's algorithm dynamically adjusts interest rates based on supply and demand, ensuring that the rates remain competitive and reflective of market conditions.

Security is further enhanced through rigorous code audits and community governance. The open-source nature of the Liqwid Protocol allows developers from around the world to inspect and contribute to the codebase, identifying potential vulnerabilities and suggesting improvements. Community governance ensures that decisions regarding the protocol's development and operation are made democratically, with token holders having a say in the future direction of the platform.

The integration of these technologies creates a comprehensive ecosystem where users can lend, borrow, and earn interest on their assets seamlessly. The non-custodial nature of the protocol, combined with the security and efficiency of the Cardano blockchain, provides a robust framework for decentralized finance activities. This ecosystem is designed to be accessible to developers as well, offering tools and APIs to build new financial products and services on top of the Liqwid Protocol.

What are the real-world applications of Liqwid Finance?

Liqwid Finance (LQ) is a non-custodial liquidity market protocol built on the Cardano blockchain. It enables users to lend and borrow assets quickly, affordably, and transparently. This decentralized finance (DeFi) platform is designed to provide liquidity solutions specifically for the Cardano ecosystem.One of the primary real-world applications of Liqwid Finance is earning interest on Cardano assets. Users can deposit their assets into the protocol and earn interest, which is generated through various yield streams. This allows individuals to grow their holdings without actively trading or engaging in complex financial maneuvers.

Borrowing is another significant application. Users can borrow assets against their deposits, providing them with liquidity without needing to sell their holdings. This is particularly useful for those who need quick access to funds but want to retain their investment positions. The borrowing process is streamlined and efficient, leveraging the speed and low transaction costs of the Cardano blockchain.

Liqwid Finance also emphasizes community-driven onchain governance. The protocol is managed through decentralized governance, meaning that upgrades and modifications are decided by the community of LQ token holders. This democratic approach ensures that the platform evolves in a way that reflects the interests and needs of its users.

The team behind Liqwid Finance, Liqwid Labs, comprises skilled Haskell and TypeScript software engineers. They focus on developing and maintaining the protocol, although they do not control it directly. Instead, the protocol operates independently through smart contracts on the Cardano blockchain, eliminating the need for financial intermediaries or custodians.

By transforming real-world assets onto digital rails, Liqwid Finance aims to disrupt traditional finance. It offers quick and affordable lending facilities, making financial services more accessible, especially for the unbanked. This approach has the potential to empower individuals who have been excluded from traditional financial systems, providing them with new opportunities for economic participation.

What key events have there been for Liqwid Finance?

Liqwid Finance, an open-source, algorithmic, and non-custodial interest rate protocol, has carved a niche for itself in the decentralized finance (DeFi) space. Built on the Cardano blockchain, it offers a platform where lenders, borrowers, and developers can interact seamlessly, earning interest on deposits and borrowing assets efficiently.The inception of Liqwid Finance marked a significant milestone when it launched on the Cardano blockchain. This launch was pivotal as it leveraged Cardano's robust infrastructure to offer a decentralized financial ecosystem. The protocol's foundation on Cardano provided it with a secure and scalable environment, essential for its growth and adoption.

The development of the Liqwid Finance team has been another cornerstone event. The team, comprising experts in blockchain technology, finance, and software development, has been instrumental in driving the protocol's innovation and expansion. Their expertise has ensured that Liqwid Finance remains at the forefront of DeFi advancements, continually enhancing its features and capabilities.

Ongoing updates and modifications to the protocol have also been crucial. These updates are designed to improve user experience, security, and functionality. For instance, enhancements to the algorithmic interest rate model have optimized the lending and borrowing processes, making them more efficient and user-friendly. Additionally, security updates have fortified the protocol against potential vulnerabilities, ensuring the safety of users' assets.

Liqwid Finance has been gaining traction and attention in the cryptocurrency market. Recent news articles have highlighted its growth and the introduction of new products. These developments have positioned Liqwid Finance as a promising player in the DeFi space, attracting a growing user base and increasing its market presence.

Despite its growth, Liqwid Finance remains a relatively small player compared to other cryptocurrencies. However, its unique value proposition and continuous innovation have set it apart, making it a noteworthy contender in the DeFi landscape. The protocol's ability to offer multiple yield streams on ADA and its commitment to decentralization and security have been key factors in its rising popularity.

The introduction of new products has further expanded Liqwid Finance's ecosystem. These products cater to the diverse needs of its users, providing them with more options to earn and manage their assets. The continuous rollout of innovative solutions has kept the protocol relevant and competitive in the fast-evolving DeFi market.

Liqwid Finance's journey has been marked by significant milestones that have shaped its trajectory in the DeFi space. From its launch on the Cardano blockchain to the development of its team and ongoing protocol updates, each event has contributed to its growth and success. The protocol's focus on security, user experience, and innovation continues to drive its expansion and adoption among cryptocurrency enthusiasts.

Who are the founders of Liqwid Finance?

Liqwid Finance (LQ) stands out as an open-source, algorithmic, and non-custodial interest rate protocol designed for lenders, borrowers, and developers. The masterminds behind this innovative project are Dewayne Cameron, Florian Volery, Joshua Akpan, and Tashoma Vilini. Dewayne Cameron serves as the CEO, steering the strategic direction and overall vision of Liqwid Finance. Florian Volery, another co-founder, collaborates closely with the team to enhance the protocol's functionality and user experience. Joshua Akpan and Tashoma Vilini, also co-founders, contribute significantly to the development and growth of the protocol, ensuring it meets the evolving needs of the decentralized finance ecosystem.| Website | liqwid.finance/ |

| Socials | twitter.com/liqwidfinance |

| Socials | github.com/Liqwid-Labs |

| Socials | discord.com/invite/rQhbEBzpYm |

| Contracts | da8c30...244c51 |

| Explorers | cardanoscan.io/token/da8c30857834c6ae7203935b89278c532b3995245295456f993e1d244c51 |

| Wallets | daedaluswallet.io/ |

| Wallets | www.lace.io/ |

| Wallets | eternl.io/ |

| Wallets | vespr.xyz/ |