INTRO

UCO Bank, operating as a Bank, Money Transfer Service, Financial Institution, and Financial Consultant based in Kolkata, India, plays a vital role in the financial sector. As a commercial bank, UCO Bank provides a wide array of financial products and services to individuals, businesses, and institutions. These services encompass deposit accounts, lending facilities, investment options, and wealth management solutions. UCO Bank also facilitates money transfers, both domestically and internationally, catering to the needs of its diverse clientele. The bank's operations are crucial for economic development, enabling the flow of capital, fostering trade, and supporting financial stability within the region and beyond.

All You Need to Know and How it Works

UCO Bank offers various banking services, including savings and current accounts, fixed deposits, loans, credit cards, and online banking facilities. To avail of these services, customers typically need to open an account by providing necessary documentation such as identity proof and address proof. Deposits can be made through various channels like cash deposits, online transfers, or cheque deposits. Loans are provided based on eligibility criteria and creditworthiness. Online banking enables customers to manage their accounts, transfer funds, and pay bills conveniently. UCO Bank also provides financial advisory services to help customers make informed investment decisions.

What Makes ucobank.com Stand Out?

How to Maximize Your Experience on ucobank.com

Why Trust ucobank.com?

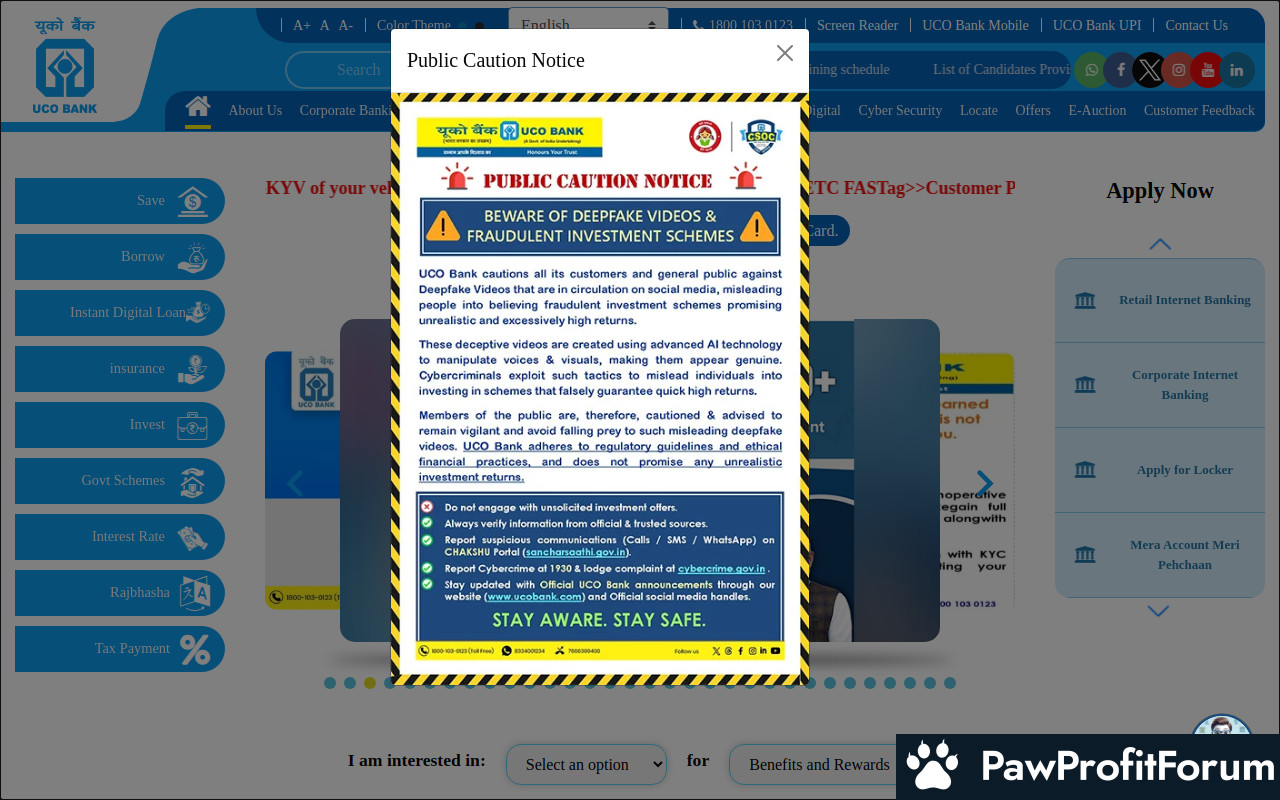

UCO Bank is a government-owned bank with a long history of serving customers in India. Being a government-owned entity, it adheres to strict regulatory guidelines and is subject to government oversight. This provides a level of assurance and trust for customers. However, it's essential to stay informed about banking regulations and security measures to protect your financial interests.

FAQs

SUMMARY

UCO Bank is a government-owned bank offering a wide range of financial products and services to customers in India. While it provides a secure and reliable banking option, it's essential to stay informed and proactive in managing your finances and reporting any issues promptly.

Given these insights, thorough research and caution are advised before engaging with ucobank.com.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

UCO Bank, operating as a Bank, Money Transfer Service, Financial Institution, and Financial Consultant based in Kolkata, India, plays a vital role in the financial sector. As a commercial bank, UCO Bank provides a wide array of financial products and services to individuals, businesses, and institutions. These services encompass deposit accounts, lending facilities, investment options, and wealth management solutions. UCO Bank also facilitates money transfers, both domestically and internationally, catering to the needs of its diverse clientele. The bank's operations are crucial for economic development, enabling the flow of capital, fostering trade, and supporting financial stability within the region and beyond.

All You Need to Know and How it Works

UCO Bank offers various banking services, including savings and current accounts, fixed deposits, loans, credit cards, and online banking facilities. To avail of these services, customers typically need to open an account by providing necessary documentation such as identity proof and address proof. Deposits can be made through various channels like cash deposits, online transfers, or cheque deposits. Loans are provided based on eligibility criteria and creditworthiness. Online banking enables customers to manage their accounts, transfer funds, and pay bills conveniently. UCO Bank also provides financial advisory services to help customers make informed investment decisions.

What Makes ucobank.com Stand Out?

- Extensive Branch Network: A wide network of branches across India.

- Diverse Financial Products: Offers a comprehensive range of financial products and services.

- Government Ownership: Being a government-owned bank, it provides a sense of security and trust.

- Online Banking Facilities: Convenient online banking services for easy account management.

- Financial Inclusion: Focuses on financial inclusion and serving rural and underserved areas.

How to Maximize Your Experience on ucobank.com

- Utilize Online Banking: Take advantage of online banking services for convenient transactions and account management.

- Explore Financial Products: Explore the various financial products and services offered to find suitable options for your needs.

- Seek Financial Advice: Consult with financial advisors for guidance on investment and financial planning.

- Stay Updated: Keep updated with the latest banking regulations and offerings.

- Report Issues Promptly: Report any issues or discrepancies immediately to the bank.

Why Trust ucobank.com?

UCO Bank is a government-owned bank with a long history of serving customers in India. Being a government-owned entity, it adheres to strict regulatory guidelines and is subject to government oversight. This provides a level of assurance and trust for customers. However, it's essential to stay informed about banking regulations and security measures to protect your financial interests.

FAQs

- Is UCO Bank a safe bank to deposit money in? Yes, being a government-owned bank, UCO Bank is considered safe for deposits.

- What types of accounts does UCO Bank offer? UCO Bank offers savings accounts, current accounts, fixed deposits, and other types of accounts.

- Does UCO Bank provide online banking services? Yes, UCO Bank provides online banking services for convenient account management.

SUMMARY

UCO Bank is a government-owned bank offering a wide range of financial products and services to customers in India. While it provides a secure and reliable banking option, it's essential to stay informed and proactive in managing your finances and reporting any issues promptly.

Given these insights, thorough research and caution are advised before engaging with ucobank.com.

Questions to Guide Your Review

- What has been your experience with ucobank.com's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does ucobank.com compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback