Introduction

United Auto Credit (UAC) operates within the financial services sector, specializing in the provision of auto loans, particularly for individuals with credit challenges. Functioning as a Non-Bank Financial Service, they facilitate car finance and loans, working with a network of dealerships to provide financing options to a broad range of customers. This includes those who may have difficulty securing traditional bank loans due to credit scores or other financial constraints. The role of UAC is crucial in enabling individuals to purchase vehicles, thereby impacting personal mobility and economic activity. United Auto Credit acts as a critical bridge between dealerships and customers who need financial assistance to buy a car, impacting a vast sector of the economy.

All You Need to Know and How it Works

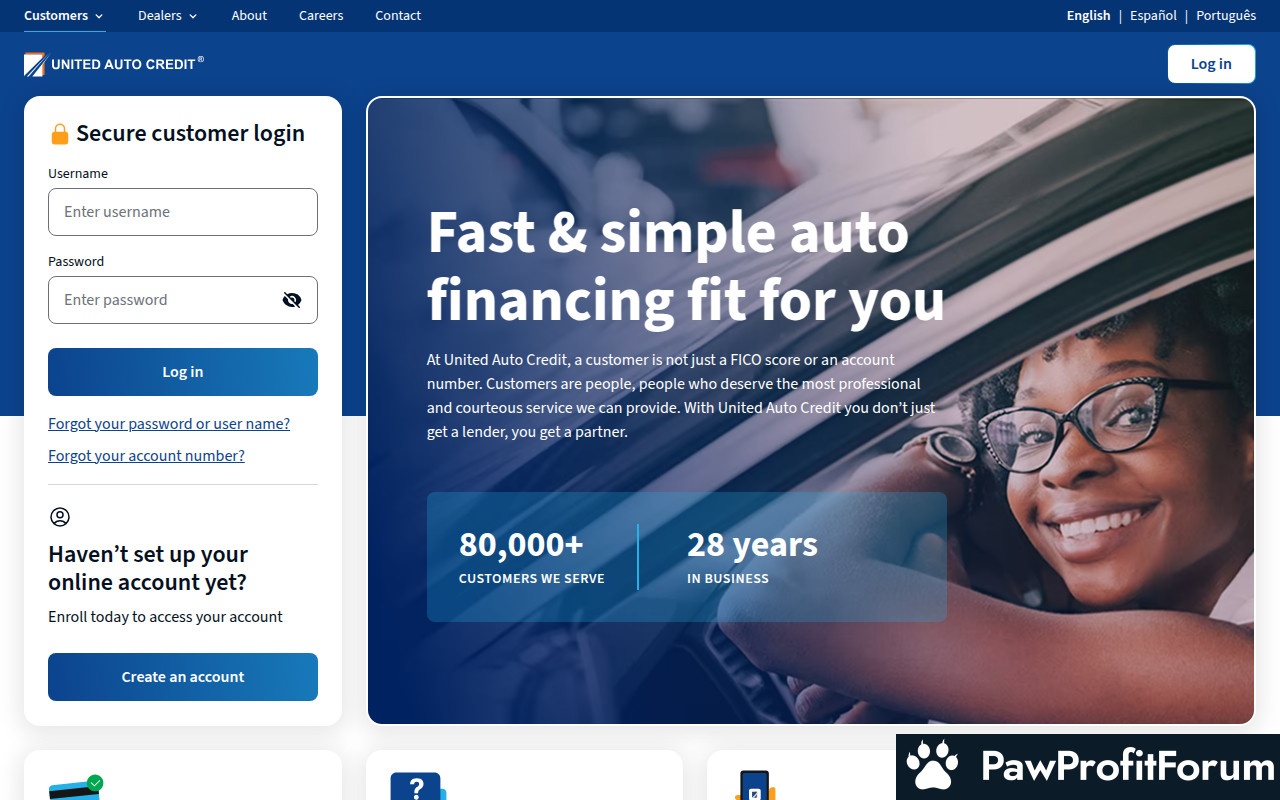

United Auto Credit offers auto loans through a network of partner dealerships. Customers apply for financing at the dealership when purchasing a vehicle. UAC then evaluates the creditworthiness of the applicant, often considering factors beyond traditional credit scores. If approved, UAC provides the financing, and the customer makes regular payments according to the loan terms. UAC specializes in serving individuals with less-than-perfect credit, providing an avenue for car ownership that might otherwise be unavailable.

What Makes unitedautocredit.net Stand Out?

How to Maximize Your Experience on unitedautocredit.net

Why Trust unitedautocredit.net?

United Auto Credit has established itself within the auto finance industry, focusing on a specific niche of customers with credit challenges. Their long-standing presence and partnerships with numerous dealerships suggest a degree of reliability. However, as with any financial service, potential customers should conduct thorough due diligence, read reviews, and understand the terms and conditions to make an informed decision.

FAQs

Concluding Summary

United Auto Credit provides a valuable service in the auto finance industry by offering loan options to individuals with credit challenges. While they offer a path to car ownership for many, it's crucial for potential customers to conduct thorough research, understand the loan terms, and compare their options before making a decision.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

United Auto Credit (UAC) operates within the financial services sector, specializing in the provision of auto loans, particularly for individuals with credit challenges. Functioning as a Non-Bank Financial Service, they facilitate car finance and loans, working with a network of dealerships to provide financing options to a broad range of customers. This includes those who may have difficulty securing traditional bank loans due to credit scores or other financial constraints. The role of UAC is crucial in enabling individuals to purchase vehicles, thereby impacting personal mobility and economic activity. United Auto Credit acts as a critical bridge between dealerships and customers who need financial assistance to buy a car, impacting a vast sector of the economy.

All You Need to Know and How it Works

United Auto Credit offers auto loans through a network of partner dealerships. Customers apply for financing at the dealership when purchasing a vehicle. UAC then evaluates the creditworthiness of the applicant, often considering factors beyond traditional credit scores. If approved, UAC provides the financing, and the customer makes regular payments according to the loan terms. UAC specializes in serving individuals with less-than-perfect credit, providing an avenue for car ownership that might otherwise be unavailable.

What Makes unitedautocredit.net Stand Out?

- Specialization in financing for individuals with credit challenges

- Partnerships with a wide network of dealerships

- Focus on enabling car ownership for a broad range of customers

- Provides alternative financing options where traditional banks may not

- Streamlined application process at the dealership level

How to Maximize Your Experience on unitedautocredit.net

- Understand the loan terms and conditions fully before committing.

- Check interest rates and compare with other financing options.

- Maintain consistent communication with UAC or the dealership regarding your loan.

- Ensure all documentation is accurate and complete during the application process.

- Use the online resources, if available, to manage your account and payments.

Why Trust unitedautocredit.net?

United Auto Credit has established itself within the auto finance industry, focusing on a specific niche of customers with credit challenges. Their long-standing presence and partnerships with numerous dealerships suggest a degree of reliability. However, as with any financial service, potential customers should conduct thorough due diligence, read reviews, and understand the terms and conditions to make an informed decision.

FAQs

- What credit scores does unitedautocredit.net work with?

United Auto Credit specializes in financing for individuals with less-than-perfect credit. They consider factors beyond traditional credit scores. - How do I apply for a loan through unitedautocredit.net?

You apply for financing at a partner dealership when purchasing a vehicle. The dealership will handle the application process with UAC. - What types of vehicles can I finance through unitedautocredit.net?

UAC typically finances a wide range of vehicles, but it's best to check with the specific dealership and UAC regarding any vehicle restrictions.

Concluding Summary

United Auto Credit provides a valuable service in the auto finance industry by offering loan options to individuals with credit challenges. While they offer a path to car ownership for many, it's crucial for potential customers to conduct thorough research, understand the loan terms, and compare their options before making a decision.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback