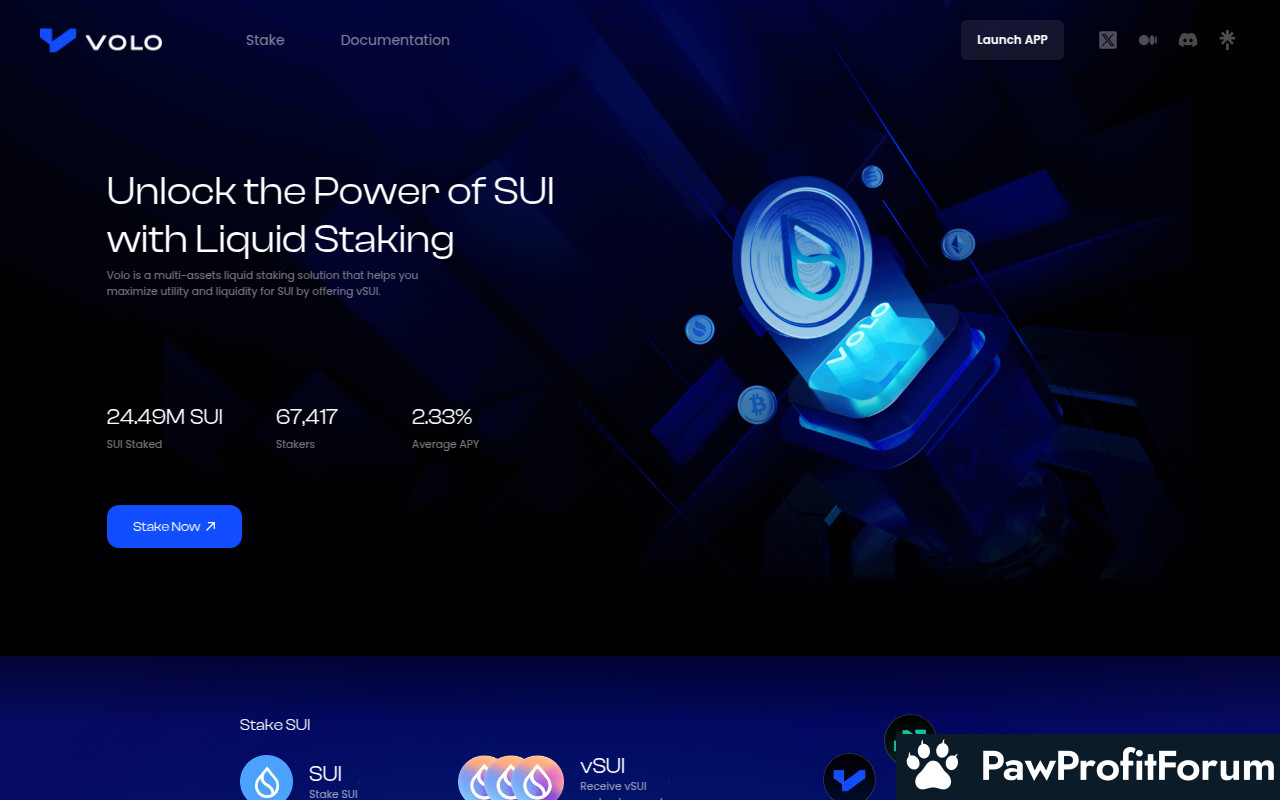

Volo is a liquid staking solution that helps you maximize utility and liquidity for SUI by offering voloSUI.

The platform's partnership with Navi Protocol and Ankr underscores its commitment to robust network integration and security. By leveraging these partnerships, Volo Staked SUI enhances its staking contracts, ensuring a reliable and efficient user experience. With a total value locked (TVL) of $50 million, it signifies strong trust and adoption within the crypto community.

Volo's liquid staking solution, voloSUI, is designed to maximize the utility and liquidity of SUI tokens. This approach allows users to participate in staking without sacrificing the flexibility of their assets. As a live project on the Mainnet, Volo Staked SUI continues to evolve, offering innovative solutions that align with the fast-paced developments in blockchain technology.

The Sui Network, which underpins VSUI, is a blockchain designed to handle high throughput and low latency, making it well-suited for DeFi applications. This network employs a consensus mechanism that ensures security and efficiency, preventing attacks from malicious actors. By utilizing a combination of proof-of-stake (PoS) and Byzantine Fault Tolerance (BFT) protocols, the Sui Network can achieve consensus even in the presence of some faulty or malicious nodes, thus safeguarding the integrity of the blockchain.

In the realm of liquid staking, Volo Staked SUI introduces voloSUI, a derivative token that represents staked SUI. This token can be used across various DeFi platforms, providing users with the flexibility to earn rewards from staking while simultaneously participating in other financial activities. This dual functionality is a key innovation, as it allows for greater capital efficiency and broader participation in the DeFi ecosystem.

The technology behind VSUI is not only about staking and liquidity but also about fostering a community-driven approach through its DAO structure. This decentralized governance model empowers users to have a say in the development and direction of the platform, ensuring that it evolves in line with the needs and preferences of its community. The DAO framework is pivotal in maintaining transparency and decentralization, as decisions are made collectively rather than by a central authority.

Moreover, the integration of VSUI with various DeFi applications on the Sui Network opens up a plethora of opportunities for users. By participating in these applications, users can engage in activities such as lending, borrowing, and yield farming, all while benefiting from the liquidity provided by liquid staking. This interconnectedness within the DeFi space enhances the overall utility of the SUI tokens and contributes to a more vibrant and dynamic financial ecosystem.

The technical infrastructure supporting Volo Staked SUI is accessible to developers and enthusiasts through platforms like GitHub, where the liquid staking contracts are available for review and contribution. This open-source approach encourages collaboration and innovation, allowing the community to contribute to the platform's growth and improvement. Additionally, social media channels like Twitter provide a space for ongoing dialogue and updates, fostering a sense of community and engagement among users and developers alike.

In essence, Volo Staked SUI exemplifies the convergence of blockchain technology, DeFi, and community governance, creating a robust platform that maximizes the potential of SUI tokens. By enabling liquid staking and integrating with the Sui Network's DeFi applications, VSUI offers a comprehensive solution that enhances liquidity, utility, and user participation in the decentralized financial landscape.

One of the standout applications of VSUI is its integration into decentralized finance (DeFi) ecosystems. It serves as collateral for borrowing and lending, enabling users to leverage their staked assets for additional financial activities. This is particularly evident in partnerships with protocols like NAVI Protocol, Turbos Finance, and Bucket Protocol, where VSUI can be used for interest-free borrowing, thus expanding its utility in DeFi applications.

Moreover, VSUI is instrumental in building innovative collateralized debt position (CDP) DeFi protocols. These protocols allow users to create stablecoins or other assets by locking VSUI as collateral, providing a new dimension of financial products on the Sui Network. This application not only enhances the versatility of VSUI but also contributes to the growth of total value locked (TVL) on the network, marking significant milestones in its development.

In addition to its DeFi applications, VSUI is recognized as a game-changer for the Sui Network by solidifying its position as the premier liquid staking token (LST). This status is further reinforced through strategic partnerships with other protocols, such as Ankr, which help to expand its reach and functionality.

At the time of writing, these applications underscore VSUI's role in advancing the capabilities of the Sui Network, offering users a robust and flexible tool for maximizing their crypto assets' potential.

One notable event in the journey of Volo Staked SUI is its strategic partnership with Navi Protocol. This collaboration aims to integrate advanced blockchain solutions, enhancing the functionality and reach of VSUI within the broader cryptocurrency landscape. The partnership signifies a commitment to leveraging cutting-edge technology to provide users with a seamless staking experience.

Another significant milestone for VSUI is its alliance with Ankr. This partnership focuses on expanding the infrastructure and capabilities of Volo Staked SUI, ensuring that users have access to robust and reliable staking services. Ankr's expertise in decentralized infrastructure plays a crucial role in supporting the scalability and efficiency of VSUI's operations.

The release of Volo's liquid staking protocol represents a major advancement in the staking ecosystem. This protocol allows users to stake their SUI tokens while retaining the ability to trade or utilize them in other DeFi applications. By offering this flexibility, Volo Staked SUI addresses a common limitation in traditional staking models, where tokens are often locked and inaccessible.

These key events underscore the dynamic nature of Volo Staked SUI's development and its commitment to providing innovative solutions within the blockchain space. Through strategic partnerships and technological advancements, VSUI continues to evolve, offering users enhanced opportunities for participation and reward in the SUI ecosystem.

What is Volo Staked SUI?

Volo Staked SUI (VSUI) emerges as a dynamic player in the decentralized finance (DeFi) ecosystem, offering a unique blend of DAO governance and liquid staking capabilities on the Sui Network. This platform is not just a staking solution; it integrates seamlessly with the broader DeFi landscape, allowing users to earn rewards while maintaining liquidity. The value of VSUI increases daily, making it an attractive option for those looking to maximize their cryptocurrency holdings.The platform's partnership with Navi Protocol and Ankr underscores its commitment to robust network integration and security. By leveraging these partnerships, Volo Staked SUI enhances its staking contracts, ensuring a reliable and efficient user experience. With a total value locked (TVL) of $50 million, it signifies strong trust and adoption within the crypto community.

Volo's liquid staking solution, voloSUI, is designed to maximize the utility and liquidity of SUI tokens. This approach allows users to participate in staking without sacrificing the flexibility of their assets. As a live project on the Mainnet, Volo Staked SUI continues to evolve, offering innovative solutions that align with the fast-paced developments in blockchain technology.

What is the technology behind Volo Staked SUI?

Volo Staked SUI (VSUI) represents a sophisticated blend of blockchain technology and decentralized finance (DeFi) principles, operating on the Sui Network. At its core, VSUI is a decentralized autonomous organization (DAO) and DeFi platform that leverages liquid staking to enhance the utility and liquidity of SUI tokens. Liquid staking is a process that allows SUI holders to stake their tokens while still maintaining liquidity, enabling them to engage in various DeFi applications without locking up their assets.The Sui Network, which underpins VSUI, is a blockchain designed to handle high throughput and low latency, making it well-suited for DeFi applications. This network employs a consensus mechanism that ensures security and efficiency, preventing attacks from malicious actors. By utilizing a combination of proof-of-stake (PoS) and Byzantine Fault Tolerance (BFT) protocols, the Sui Network can achieve consensus even in the presence of some faulty or malicious nodes, thus safeguarding the integrity of the blockchain.

In the realm of liquid staking, Volo Staked SUI introduces voloSUI, a derivative token that represents staked SUI. This token can be used across various DeFi platforms, providing users with the flexibility to earn rewards from staking while simultaneously participating in other financial activities. This dual functionality is a key innovation, as it allows for greater capital efficiency and broader participation in the DeFi ecosystem.

The technology behind VSUI is not only about staking and liquidity but also about fostering a community-driven approach through its DAO structure. This decentralized governance model empowers users to have a say in the development and direction of the platform, ensuring that it evolves in line with the needs and preferences of its community. The DAO framework is pivotal in maintaining transparency and decentralization, as decisions are made collectively rather than by a central authority.

Moreover, the integration of VSUI with various DeFi applications on the Sui Network opens up a plethora of opportunities for users. By participating in these applications, users can engage in activities such as lending, borrowing, and yield farming, all while benefiting from the liquidity provided by liquid staking. This interconnectedness within the DeFi space enhances the overall utility of the SUI tokens and contributes to a more vibrant and dynamic financial ecosystem.

The technical infrastructure supporting Volo Staked SUI is accessible to developers and enthusiasts through platforms like GitHub, where the liquid staking contracts are available for review and contribution. This open-source approach encourages collaboration and innovation, allowing the community to contribute to the platform's growth and improvement. Additionally, social media channels like Twitter provide a space for ongoing dialogue and updates, fostering a sense of community and engagement among users and developers alike.

In essence, Volo Staked SUI exemplifies the convergence of blockchain technology, DeFi, and community governance, creating a robust platform that maximizes the potential of SUI tokens. By enabling liquid staking and integrating with the Sui Network's DeFi applications, VSUI offers a comprehensive solution that enhances liquidity, utility, and user participation in the decentralized financial landscape.

What are the real-world applications of Volo Staked SUI?

Volo Staked SUI (VSUI) emerges as a pivotal player in the cryptocurrency landscape, primarily through its role as a liquid staking protocol on the Sui Network. This protocol allows users to stake their SUI tokens, enhancing liquidity and utility without locking up their assets. By participating in liquid staking, users can earn rewards while maintaining the flexibility to trade or use their tokens elsewhere.One of the standout applications of VSUI is its integration into decentralized finance (DeFi) ecosystems. It serves as collateral for borrowing and lending, enabling users to leverage their staked assets for additional financial activities. This is particularly evident in partnerships with protocols like NAVI Protocol, Turbos Finance, and Bucket Protocol, where VSUI can be used for interest-free borrowing, thus expanding its utility in DeFi applications.

Moreover, VSUI is instrumental in building innovative collateralized debt position (CDP) DeFi protocols. These protocols allow users to create stablecoins or other assets by locking VSUI as collateral, providing a new dimension of financial products on the Sui Network. This application not only enhances the versatility of VSUI but also contributes to the growth of total value locked (TVL) on the network, marking significant milestones in its development.

In addition to its DeFi applications, VSUI is recognized as a game-changer for the Sui Network by solidifying its position as the premier liquid staking token (LST). This status is further reinforced through strategic partnerships with other protocols, such as Ankr, which help to expand its reach and functionality.

At the time of writing, these applications underscore VSUI's role in advancing the capabilities of the Sui Network, offering users a robust and flexible tool for maximizing their crypto assets' potential.

What key events have there been for Volo Staked SUI?

Volo Staked SUI (VSUI) emerges as a liquid staking solution designed to enhance the utility and liquidity of SUI tokens. By allowing users to earn rewards while maintaining liquidity, VSUI offers a compelling option for those engaged in the SUI ecosystem. This innovative approach to staking has been marked by several pivotal events that have shaped its development and adoption.One notable event in the journey of Volo Staked SUI is its strategic partnership with Navi Protocol. This collaboration aims to integrate advanced blockchain solutions, enhancing the functionality and reach of VSUI within the broader cryptocurrency landscape. The partnership signifies a commitment to leveraging cutting-edge technology to provide users with a seamless staking experience.

Another significant milestone for VSUI is its alliance with Ankr. This partnership focuses on expanding the infrastructure and capabilities of Volo Staked SUI, ensuring that users have access to robust and reliable staking services. Ankr's expertise in decentralized infrastructure plays a crucial role in supporting the scalability and efficiency of VSUI's operations.

The release of Volo's liquid staking protocol represents a major advancement in the staking ecosystem. This protocol allows users to stake their SUI tokens while retaining the ability to trade or utilize them in other DeFi applications. By offering this flexibility, Volo Staked SUI addresses a common limitation in traditional staking models, where tokens are often locked and inaccessible.

These key events underscore the dynamic nature of Volo Staked SUI's development and its commitment to providing innovative solutions within the blockchain space. Through strategic partnerships and technological advancements, VSUI continues to evolve, offering users enhanced opportunities for participation and reward in the SUI ecosystem.

Who are the founders of Volo Staked SUI?

Volo Staked SUI (VSUI) emerges as a pivotal player in the realm of liquid staking, designed to enhance utility and liquidity for SUI. The brains behind this innovative solution include Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Chalkias. These founders bring a wealth of experience from their backgrounds in blockchain technology and software development. Their collective expertise has been instrumental in shaping Volo Staked SUI into a robust platform. In January 2021, Volo Staked SUI was acquired by NAVI Protocol, marking a significant milestone in the Sui Ecosystem by integrating borrowing, lending, and liquid staking functionalities.| Website | www.volo.fi/ |

| Socials | twitter.com/volo_sui |

| Socials | github.com/Sui-Volo/volo-liquid-staking-contracts |

| Socials | discord.com/invite/volo |

| Contracts | 0x549e...::CERT |

| Explorers | suivision.xyz/coin/0x549e8b69270defbfafd4f94e17ec44cdbdd99820b33bda2278dea3b9a32d3f55::cert::CERT |