INTRO

Ziploan.in is an online lending platform focused on providing business loans to small and medium-sized enterprises (SMEs) in India. Operating within the financial services sector, the platform aims to bridge the funding gap for businesses that often face challenges in securing loans from traditional banking institutions. Ziploan.in leverages technology and data analytics to streamline the loan application and approval process, making it more accessible and efficient for SMEs seeking financial assistance. The platform offers various loan products tailored to meet the diverse needs of small businesses, contributing to their growth and development. Ziploan serves businesses across various sectors, aiming to boost the entrepreneurial ecosystem by providing timely and flexible financial solutions.

All You Need to Know and How it Works

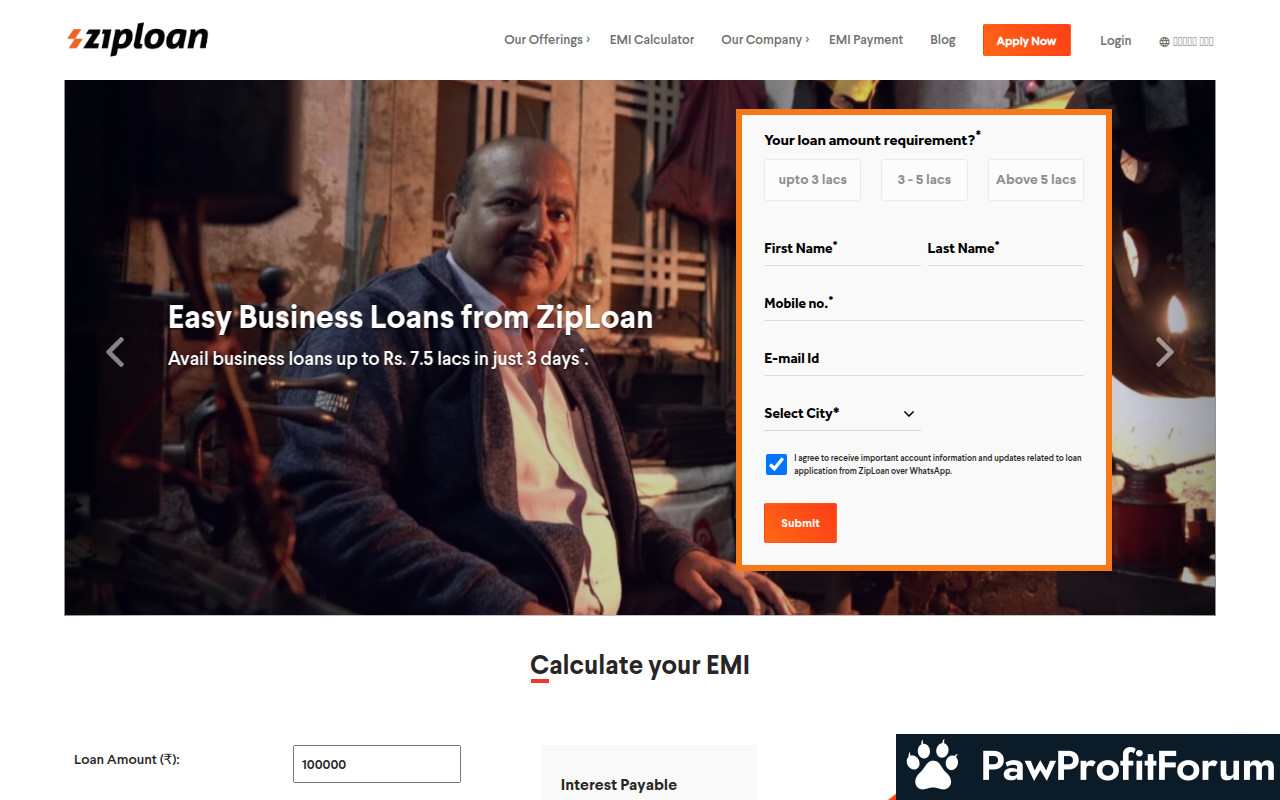

Ziploan.in simplifies the loan application process for SMEs. Businesses can apply for a loan online by providing necessary information and documents. The platform then assesses the application using advanced algorithms and data analytics to determine creditworthiness. Once approved, the loan amount is disbursed quickly, enabling businesses to utilize the funds for various purposes such as working capital, expansion, or equipment purchase. Ziploan.in offers flexible repayment options, making it easier for businesses to manage their finances effectively. The platform also provides ongoing support and guidance to help SMEs succeed.

What Makes ziploan.in Stand Out?

How to Maximize Your Experience on ziploan.in

Why Trust ziploan.in?

Ziploan.in has established itself as a reliable online lending platform for SMEs in India. The platform uses secure technology and follows industry best practices to protect user data and ensure transparency. Ziploan.in has received positive feedback from many businesses that have benefited from its services. The company is committed to providing ethical and responsible lending solutions, making it a trustworthy partner for SMEs.

FAQs

SUMMARY

Ziploan.in is a valuable resource for SMEs in India seeking access to business loans. The platform's efficient online process, tailored loan products, and commitment to customer support make it a standout player in the online lending space. By offering flexible repayment options and utilizing data-driven credit assessment, Ziploan.in helps businesses grow and succeed. Its focus on ethical and responsible lending practices further solidifies its reputation as a trusted partner for SMEs.

Given these insights, thorough research and caution are advised before engaging with ziploan.in.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

Ziploan.in is an online lending platform focused on providing business loans to small and medium-sized enterprises (SMEs) in India. Operating within the financial services sector, the platform aims to bridge the funding gap for businesses that often face challenges in securing loans from traditional banking institutions. Ziploan.in leverages technology and data analytics to streamline the loan application and approval process, making it more accessible and efficient for SMEs seeking financial assistance. The platform offers various loan products tailored to meet the diverse needs of small businesses, contributing to their growth and development. Ziploan serves businesses across various sectors, aiming to boost the entrepreneurial ecosystem by providing timely and flexible financial solutions.

All You Need to Know and How it Works

Ziploan.in simplifies the loan application process for SMEs. Businesses can apply for a loan online by providing necessary information and documents. The platform then assesses the application using advanced algorithms and data analytics to determine creditworthiness. Once approved, the loan amount is disbursed quickly, enabling businesses to utilize the funds for various purposes such as working capital, expansion, or equipment purchase. Ziploan.in offers flexible repayment options, making it easier for businesses to manage their finances effectively. The platform also provides ongoing support and guidance to help SMEs succeed.

What Makes ziploan.in Stand Out?

- Quick and efficient loan processing

- Tailored loan products for SMEs

- Flexible repayment options

- Data-driven credit assessment

- Accessible online platform

- Support and guidance for businesses

How to Maximize Your Experience on ziploan.in

- Explore the different loan products available

- Ensure all required documents are readily available

- Use the online tools and resources provided

- Contact customer support for any queries or assistance

- Stay informed about new offerings and updates

Why Trust ziploan.in?

Ziploan.in has established itself as a reliable online lending platform for SMEs in India. The platform uses secure technology and follows industry best practices to protect user data and ensure transparency. Ziploan.in has received positive feedback from many businesses that have benefited from its services. The company is committed to providing ethical and responsible lending solutions, making it a trustworthy partner for SMEs.

FAQs

- What types of loans does ziploan.in offer?

Answer: Ziploan.in offers various types of business loans, including working capital loans, term loans, and loans for equipment purchase. - What is the loan application process?

Answer: The loan application process is online and involves providing necessary information and documents. Ziploan.in uses data analytics to assess the application and provide a quick decision. - What are the repayment options?

Answer: Ziploan.in offers flexible repayment options to suit the needs of different businesses.

SUMMARY

Ziploan.in is a valuable resource for SMEs in India seeking access to business loans. The platform's efficient online process, tailored loan products, and commitment to customer support make it a standout player in the online lending space. By offering flexible repayment options and utilizing data-driven credit assessment, Ziploan.in helps businesses grow and succeed. Its focus on ethical and responsible lending practices further solidifies its reputation as a trusted partner for SMEs.

Given these insights, thorough research and caution are advised before engaging with ziploan.in.

Questions to Guide Your Review

- What has been your experience with ziploan.in's services?

- Have you encountered any issues with the loan application or disbursement process?

- How does ziploan.in compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback