INTRO

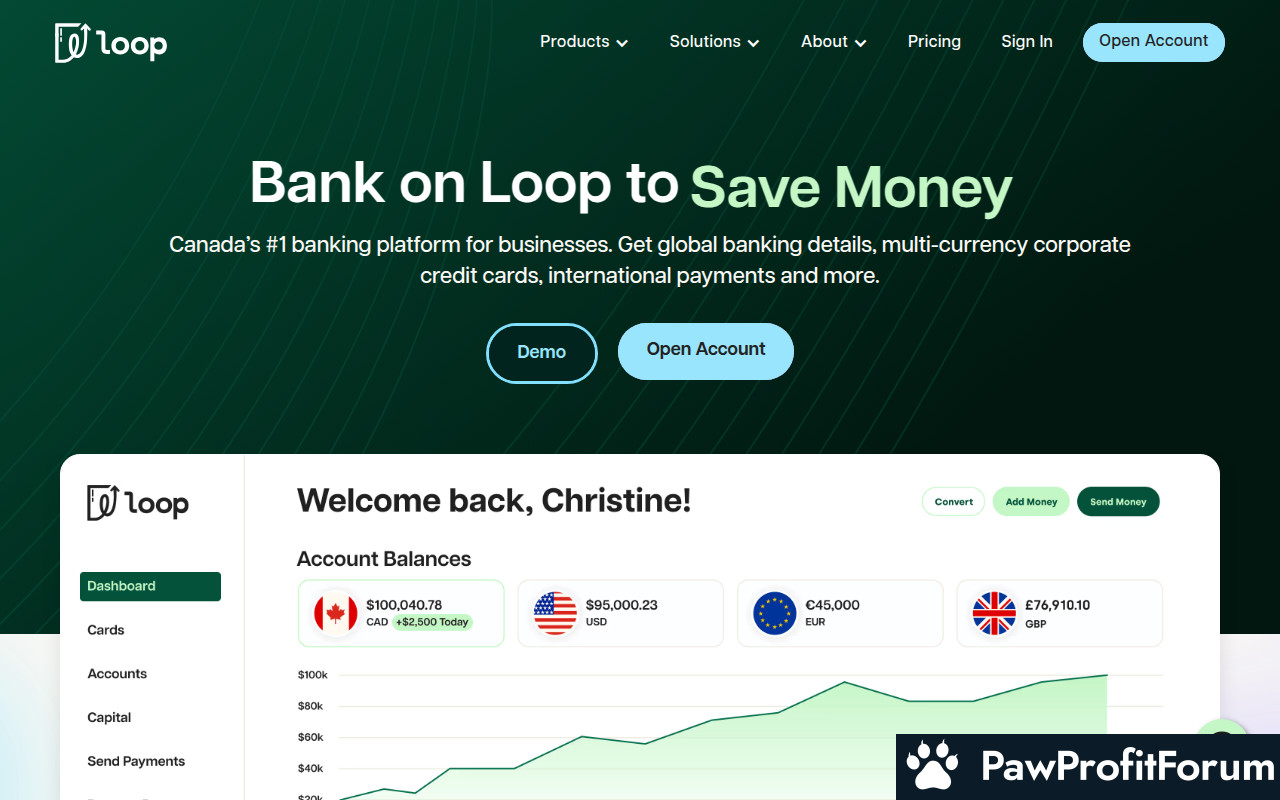

BankOnLoop operates within the dynamic landscape of non-bank financial services, striving to provide innovative solutions to its clientele. Based in Toronto, Canada, BankOnLoop likely aims to offer a range of financial products and services that cater to specific needs within the market. These services may include facilitating transactions, managing assets, or providing alternative financial solutions outside the traditional banking system. The company's approach to addressing financial requirements and its commitment to serving a diverse clientele are essential aspects of its operations.

ALL YOU NEED TO KNOW AND HOW IT WORKS

BankOnLoop likely functions by providing specialized financial services to individuals and businesses. Its operations could encompass a variety of activities, such as processing payments, offering alternative lending options, or managing investment portfolios. The company's approach to delivering these services may involve leveraging technology to streamline processes and enhance efficiency. By tailoring its services to meet specific client needs, BankOnLoop aims to provide value and support to its customer base.

What Makes BankOnLoop Stand Out?

How to Maximize Your Experience on BankOnLoop

Why Trust BankOnLoop?

BankOnLoop's credibility is built on its commitment to transparency, security, and regulatory compliance. By adhering to industry standards and maintaining strong ethical principles, the company aims to establish trust with its customers. Transparent communication, secure data handling, and robust compliance measures are essential components of BankOnLoop's approach to building and maintaining a strong reputation.

FAQs

SUMMARY

In summary, BankOnLoop aims to deliver innovative non-bank financial solutions to meet the evolving needs of its clientele. By focusing on customer satisfaction, technological integration, and regulatory compliance, the company strives to provide a reliable and valuable service to its customers. Transparency, security, and a customer-centric approach are key pillars of BankOnLoop's operations.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

BankOnLoop operates within the dynamic landscape of non-bank financial services, striving to provide innovative solutions to its clientele. Based in Toronto, Canada, BankOnLoop likely aims to offer a range of financial products and services that cater to specific needs within the market. These services may include facilitating transactions, managing assets, or providing alternative financial solutions outside the traditional banking system. The company's approach to addressing financial requirements and its commitment to serving a diverse clientele are essential aspects of its operations.

ALL YOU NEED TO KNOW AND HOW IT WORKS

BankOnLoop likely functions by providing specialized financial services to individuals and businesses. Its operations could encompass a variety of activities, such as processing payments, offering alternative lending options, or managing investment portfolios. The company's approach to delivering these services may involve leveraging technology to streamline processes and enhance efficiency. By tailoring its services to meet specific client needs, BankOnLoop aims to provide value and support to its customer base.

What Makes BankOnLoop Stand Out?

- Innovative Financial Solutions

- Customer-Centric Approach

- Technological Integration

- Commitment to Compliance

How to Maximize Your Experience on BankOnLoop

- Explore Service Offerings

- Communicate Your Needs

- Provide Feedback

- Stay Informed

Why Trust BankOnLoop?

BankOnLoop's credibility is built on its commitment to transparency, security, and regulatory compliance. By adhering to industry standards and maintaining strong ethical principles, the company aims to establish trust with its customers. Transparent communication, secure data handling, and robust compliance measures are essential components of BankOnLoop's approach to building and maintaining a strong reputation.

FAQs

- What types of financial services does BankOnLoop offer?

BankOnLoop likely provides a range of non-bank financial services, including payment processing, lending solutions, and investment management. - How does BankOnLoop ensure the security of customer data?

BankOnLoop implements robust security measures and adheres to data protection regulations to safeguard customer information. - How can I provide feedback to BankOnLoop about my experience?

Customers can provide feedback through various channels, such as surveys, direct communication, or online reviews.

SUMMARY

In summary, BankOnLoop aims to deliver innovative non-bank financial solutions to meet the evolving needs of its clientele. By focusing on customer satisfaction, technological integration, and regulatory compliance, the company strives to provide a reliable and valuable service to its customers. Transparency, security, and a customer-centric approach are key pillars of BankOnLoop's operations.

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback