INTRO

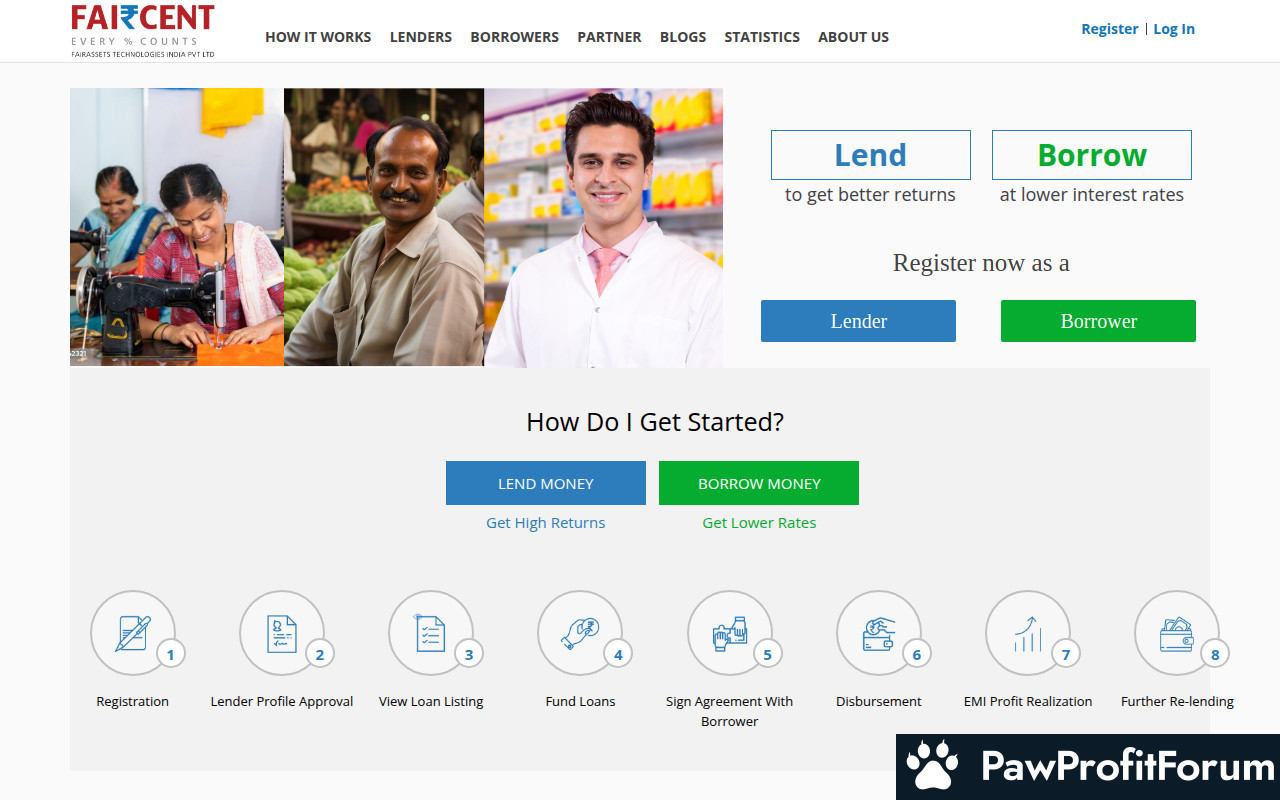

Faircent.com is an online platform operating in the Money & Insurance sector, based in Gurgaon, India, that connects borrowers directly with lenders, cutting out the traditional banking intermediaries. This peer-to-peer (P2P) lending model aims to offer better interest rates to borrowers and higher returns to lenders, while providing a convenient and transparent platform for financial transactions.

All You Need to Know and How it Works

Faircent.com functions as a marketplace where individuals and businesses can apply for loans or invest in loans. Borrowers create loan requests with details such as the loan amount, purpose, and desired interest rate. Lenders can then browse these requests and choose to fund loans that meet their investment criteria. Faircent.com facilitates the loan agreement, manages the repayment process, and handles collections in case of defaults. The platform charges fees to both borrowers and lenders for its services.

What Makes Faircent.com Stand Out?

How to Maximize Your Experience on Faircent.com

Why Trust Faircent.com?

Faircent.com has established itself as a prominent player in the P2P lending space in India. They are a registered Non-Banking Financial Company (NBFC-P2P) with the Reserve Bank of India (RBI), providing a regulatory framework and oversight. The platform also employs risk assessment models and collection mechanisms to safeguard the interests of lenders. However, as with any investment, there are risks involved, and users should exercise caution and conduct their own due diligence.

FAQs

SUMMARY

Faircent.com is a P2P lending platform that offers an alternative to traditional banking for borrowers and lenders. While it provides potential benefits such as competitive rates and a convenient online process, users should be aware of the risks involved and exercise caution. The platform's regulatory compliance and risk management efforts aim to build trust, but due diligence is always recommended.

Given these insights, thorough research and caution are advised before engaging with Faircent.com.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

Faircent.com is an online platform operating in the Money & Insurance sector, based in Gurgaon, India, that connects borrowers directly with lenders, cutting out the traditional banking intermediaries. This peer-to-peer (P2P) lending model aims to offer better interest rates to borrowers and higher returns to lenders, while providing a convenient and transparent platform for financial transactions.

All You Need to Know and How it Works

Faircent.com functions as a marketplace where individuals and businesses can apply for loans or invest in loans. Borrowers create loan requests with details such as the loan amount, purpose, and desired interest rate. Lenders can then browse these requests and choose to fund loans that meet their investment criteria. Faircent.com facilitates the loan agreement, manages the repayment process, and handles collections in case of defaults. The platform charges fees to both borrowers and lenders for its services.

What Makes Faircent.com Stand Out?

- Direct Connection: Connects borrowers and lenders directly, bypassing traditional banks.

- Competitive Rates: Aims to offer better interest rates for borrowers and higher returns for lenders.

- Transparent Platform: Provides a clear and transparent view of loan requests and investment opportunities.

- Risk Assessment: Employs a risk assessment model to evaluate borrowers and assign risk categories.

- Convenient Process: Simplifies the loan application and investment process through an online platform.

How to Maximize Your Experience on Faircent.com

- Diversify Investments: Spread your investments across multiple loan requests to mitigate risk.

- Carefully Evaluate Borrowers: Review borrower profiles and risk assessments before making lending decisions.

- Stay Informed: Keep up-to-date with market trends and Faircent.com's policies.

- Use Automated Tools: Take advantage of automated lending tools to streamline your investment process.

- Monitor Performance: Regularly track the performance of your loan portfolio.

Why Trust Faircent.com?

Faircent.com has established itself as a prominent player in the P2P lending space in India. They are a registered Non-Banking Financial Company (NBFC-P2P) with the Reserve Bank of India (RBI), providing a regulatory framework and oversight. The platform also employs risk assessment models and collection mechanisms to safeguard the interests of lenders. However, as with any investment, there are risks involved, and users should exercise caution and conduct their own due diligence.

FAQs

- What is P2P lending? P2P lending is a method of lending money to individuals or businesses through online platforms that connect borrowers with lenders directly, without using a traditional financial intermediary like a bank.

- How does Faircent.com make money? Faircent.com charges fees to both borrowers and lenders for using its platform. These fees can include origination fees for borrowers and service fees for lenders.

- What are the risks of lending on Faircent.com? The primary risk is default by the borrower, which could result in the loss of invested capital. Faircent.com mitigates this risk through risk assessment and collection processes, but it does not guarantee returns.

SUMMARY

Faircent.com is a P2P lending platform that offers an alternative to traditional banking for borrowers and lenders. While it provides potential benefits such as competitive rates and a convenient online process, users should be aware of the risks involved and exercise caution. The platform's regulatory compliance and risk management efforts aim to build trust, but due diligence is always recommended.

Given these insights, thorough research and caution are advised before engaging with Faircent.com.

Questions to Guide Your Review

- What has been your experience with Faircent.com's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does Faircent.com compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback