INTRO

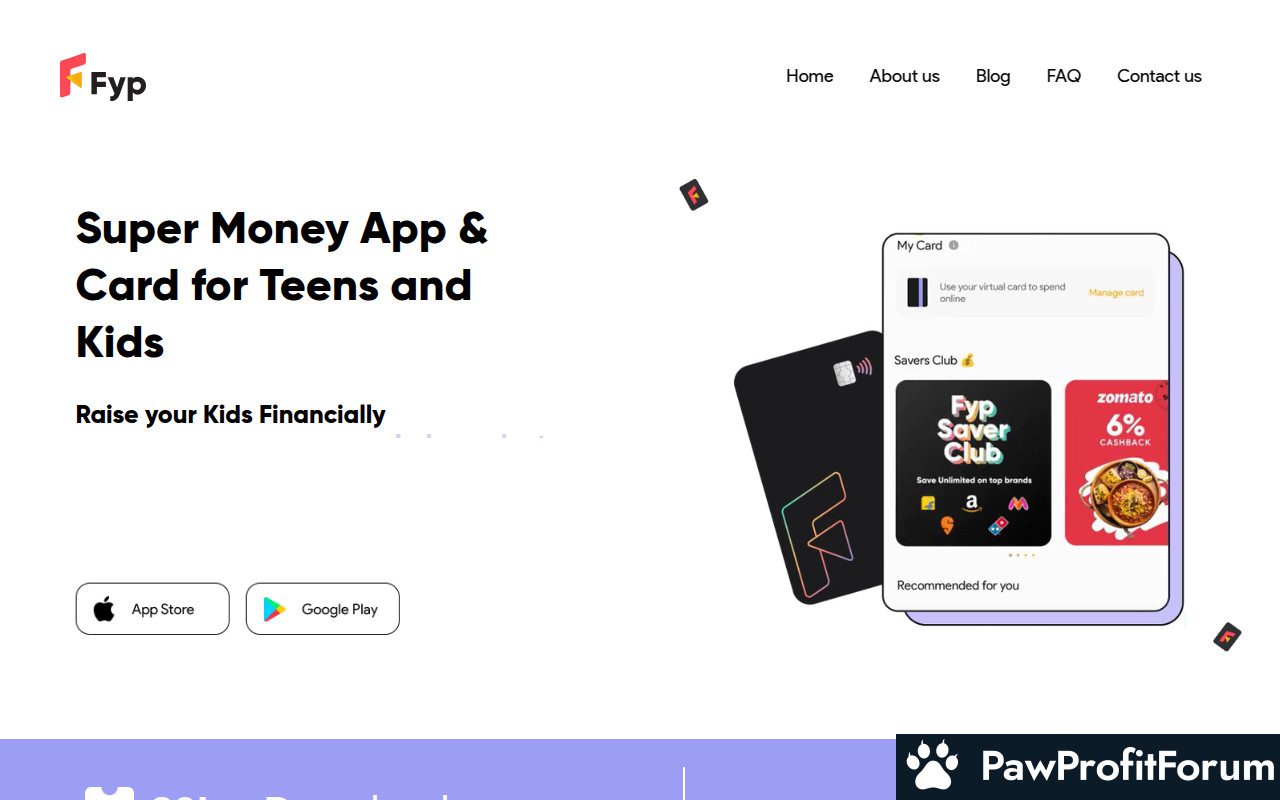

fypmoney.in is a platform operating within the fintech sector, specifically targeting young individuals with its financial services. It functions as a digital banking solution, offering features like prepaid cards, UPI payments, and expense tracking, designed to introduce teenagers and young adults to the world of digital finance. By providing a safe and controlled environment for managing money, fypmoney.in aims to foster financial literacy and responsible spending habits among its users. Its services fall under the category of non-bank financial services, providing an alternative to traditional banking for a younger demographic.

All You Need to Know and How it Works

fypmoney.in provides a prepaid card and UPI payment system tailored for teenagers. Users can load money onto the card or UPI through their parents' accounts. The platform offers expense tracking to monitor spending habits. fypmoney.in promotes financial literacy through in-app resources and tools. Parents have oversight, ensuring controlled and safe financial management for their children.

What Makes fypmoney.in Stand Out?

How to Maximize Your Experience on fypmoney.in

Why Trust fypmoney.in?

fypmoney.in partners with established financial institutions to provide secure payment solutions. The platform emphasizes transparency and parental oversight to ensure responsible financial management for young users. User testimonials and community feedback can offer insights into the platform's reliability.

FAQs

SUMMARY

fypmoney.in is a fintech platform designed to offer financial services to teenagers, focusing on prepaid cards, UPI payments, and expense tracking. It stands out with its tailored products for young users, parental oversight, and commitment to promoting financial literacy. To maximize the experience, users should explore all available features and engage with community resources. The platform's partnerships and transparency contribute to its credibility.

Given these insights, thorough research and caution are advised before engaging with fypmoney.in.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

fypmoney.in is a platform operating within the fintech sector, specifically targeting young individuals with its financial services. It functions as a digital banking solution, offering features like prepaid cards, UPI payments, and expense tracking, designed to introduce teenagers and young adults to the world of digital finance. By providing a safe and controlled environment for managing money, fypmoney.in aims to foster financial literacy and responsible spending habits among its users. Its services fall under the category of non-bank financial services, providing an alternative to traditional banking for a younger demographic.

All You Need to Know and How it Works

fypmoney.in provides a prepaid card and UPI payment system tailored for teenagers. Users can load money onto the card or UPI through their parents' accounts. The platform offers expense tracking to monitor spending habits. fypmoney.in promotes financial literacy through in-app resources and tools. Parents have oversight, ensuring controlled and safe financial management for their children.

What Makes fypmoney.in Stand Out?

- Tailored financial products for teenagers

- Integration of prepaid cards and UPI

- Expense tracking and budgeting tools

- Parental oversight for safe usage

- Focus on financial literacy

How to Maximize Your Experience on fypmoney.in

- Explore all features of the prepaid card and UPI.

- Utilize expense tracking to monitor spending.

- Engage with in-app financial literacy resources.

- Set up parental controls to manage usage.

- Participate in community forums to share tips and experiences.

Why Trust fypmoney.in?

fypmoney.in partners with established financial institutions to provide secure payment solutions. The platform emphasizes transparency and parental oversight to ensure responsible financial management for young users. User testimonials and community feedback can offer insights into the platform's reliability.

FAQs

- Is fypmoney.in safe for teenagers?

Answer: Yes, fypmoney.in incorporates parental controls and secure payment processing to ensure a safe environment for young users. - How does fypmoney.in promote financial literacy?

Answer: The platform offers in-app resources, tips, and tools to educate teenagers about responsible spending and financial management. - Can parents monitor their child's spending on fypmoney.in?

Answer: Yes, fypmoney.in provides parental oversight features, allowing parents to track and manage their child's spending activities.

SUMMARY

fypmoney.in is a fintech platform designed to offer financial services to teenagers, focusing on prepaid cards, UPI payments, and expense tracking. It stands out with its tailored products for young users, parental oversight, and commitment to promoting financial literacy. To maximize the experience, users should explore all available features and engage with community resources. The platform's partnerships and transparency contribute to its credibility.

Given these insights, thorough research and caution are advised before engaging with fypmoney.in.

Questions to Guide Your Review

- What has been your experience with fypmoney.in's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does fypmoney.in compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback