INTRO

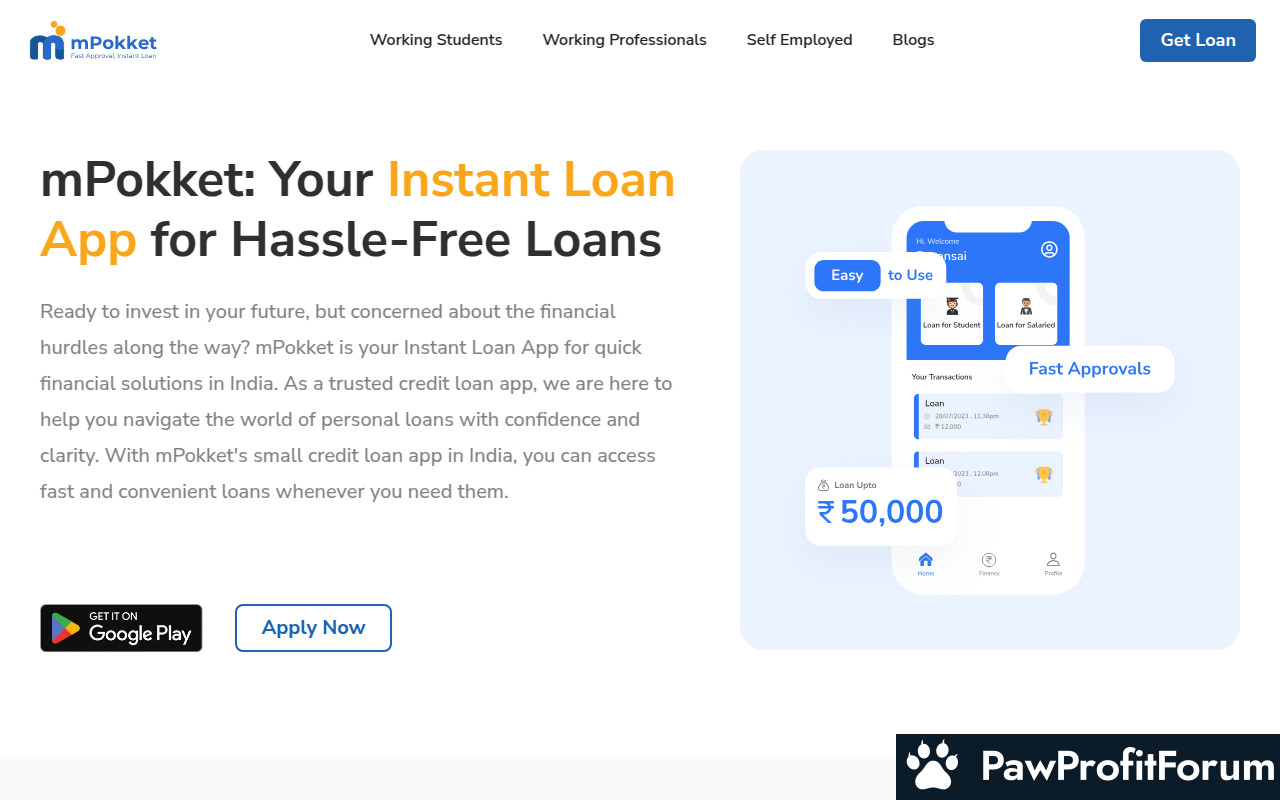

mpokket.in positions itself as a financial service catering primarily to students and young professionals in India, offering instant personal loans. In the competitive landscape of Non-Bank Financial Service, Financial Consultant, Alternative Financial Service, Loan Agency, mpokket.in aims to provide accessible credit solutions. The platform focuses on enabling users to meet immediate financial needs, providing a digital lending platform that simplifies the loan application and disbursement process.

All You Need to Know and How it Works

mpokket.in provides short-term loans to students and young professionals, requiring minimal documentation and a quick approval process. Users download the app, complete the KYC process, and apply for a loan. Once approved, the loan amount is disbursed directly into their bank account or digital wallet. Repayment is managed through the app, with various options available to suit user convenience. The platform emphasizes transparency and ease of use, making it an attractive option for those new to credit or requiring immediate funds.

What Makes mpokket.in Stand Out?

How to Maximize Your Experience on mpokket.in

Why Trust mpokket.in?

The trust in mpokket.in stems from its transparent lending practices, digital convenience, and focus on serving students and young professionals. The company adheres to regulatory standards and provides clear terms and conditions, enhancing its credibility. User reviews and testimonials highlight both positive experiences with quick disbursements and areas where improvements are needed, such as customer service responsiveness.

FAQs

Given these insights, thorough research and caution are advised before engaging with mpokket.in. Always read the terms and conditions before applying for a loan.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

mpokket.in positions itself as a financial service catering primarily to students and young professionals in India, offering instant personal loans. In the competitive landscape of Non-Bank Financial Service, Financial Consultant, Alternative Financial Service, Loan Agency, mpokket.in aims to provide accessible credit solutions. The platform focuses on enabling users to meet immediate financial needs, providing a digital lending platform that simplifies the loan application and disbursement process.

All You Need to Know and How it Works

mpokket.in provides short-term loans to students and young professionals, requiring minimal documentation and a quick approval process. Users download the app, complete the KYC process, and apply for a loan. Once approved, the loan amount is disbursed directly into their bank account or digital wallet. Repayment is managed through the app, with various options available to suit user convenience. The platform emphasizes transparency and ease of use, making it an attractive option for those new to credit or requiring immediate funds.

What Makes mpokket.in Stand Out?

- Instant Loan Approval: Quick processing for urgent financial needs.

- Minimal Documentation: Simplified KYC for easy access.

- Student-Focused: Tailored financial solutions for students.

- Digital Platform: User-friendly app for convenient loan management.

- Flexible Repayment Options: Various methods to repay loans.

How to Maximize Your Experience on mpokket.in

- Complete KYC Accurately: Ensure faster approval by providing correct details.

- Set Up Repayment Reminders: Avoid late fees by scheduling reminders.

- Explore Loan Options: Understand different loan products before applying.

- Monitor Credit Score: Use the platform to understand the impact on your creditworthiness.

- Utilize Customer Support: Reach out for any clarifications or assistance.

Why Trust mpokket.in?

The trust in mpokket.in stems from its transparent lending practices, digital convenience, and focus on serving students and young professionals. The company adheres to regulatory standards and provides clear terms and conditions, enhancing its credibility. User reviews and testimonials highlight both positive experiences with quick disbursements and areas where improvements are needed, such as customer service responsiveness.

FAQs

- What is the maximum loan amount offered by mpokket.in?

The maximum loan amount varies based on eligibility and credit assessment, typically ranging from ₹500 to ₹30,000. - What are the eligibility criteria for obtaining a loan?

Eligibility typically requires being a student or young professional with a valid ID and bank account. - How long does it take to get a loan approved?

Loan approval is usually quick, often within a few hours if all documentation is in order.

Given these insights, thorough research and caution are advised before engaging with mpokket.in. Always read the terms and conditions before applying for a loan.

Questions to Guide Your Review

- What has been your experience with mpokket.in's services?

- Have you encountered any issues with loan approvals or repayment processes?

- How does mpokket.in compare to other similar lending platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback