INTRO

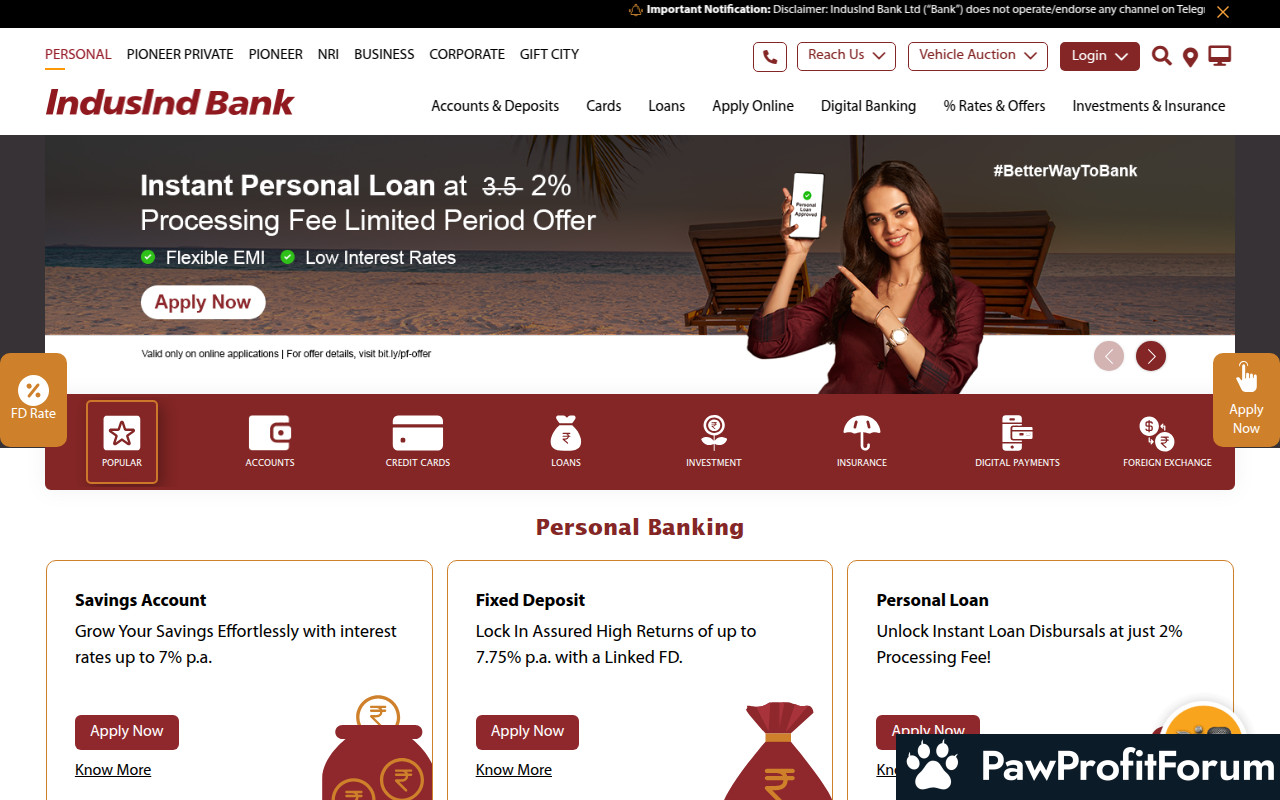

IndusInd Bank is a prominent Indian financial institution providing a wide array of banking products and services to individuals, corporates, and non-resident Indians. As a key player in the banking sector, IndusInd Bank offers services such as deposits, loans, credit cards, investment solutions, and online banking. Its operations are geared towards facilitating financial transactions, wealth management, and supporting economic growth through various lending and investment activities. It aims to be a technologically advanced and customer-centric bank, offering innovative solutions and personalized services to meet the diverse needs of its clientele. IndusInd Bank continually adapts to the changing financial landscape, focusing on regulatory compliance, risk management, and sustainable growth. They offer a full range of services, including retail banking, corporate banking, and wealth management.

All You Need to Know and How it Works

IndusInd Bank operates as a full-service commercial bank. Customers can open various types of accounts (savings, current, fixed deposits), apply for loans (personal, home, vehicle), and access credit cards. The bank also provides services like online and mobile banking for convenient transactions. For businesses, IndusInd offers corporate banking solutions including trade finance, cash management, and working capital loans. The bank earns revenue through interest on loans, fees for services, and investment activities.

What Makes IndusInd Bank Stand Out?

How to Maximize Your Experience on IndusInd Bank

Why Trust IndusInd Bank?

IndusInd Bank is a well-established and regulated financial institution in India, subject to the oversight of the Reserve Bank of India (RBI). It has a track record of financial stability and adherence to regulatory guidelines. IndusInd Bank's commitment to transparency, security measures, and customer service contributes to its trustworthiness. With a long history and a strong reputation in the Indian banking sector, IndusInd Bank is considered a reliable option for financial services.

FAQs

SUMMARY

IndusInd Bank is a significant player in the Indian banking sector, offering a wide range of financial services to individuals and businesses. Its focus on technology, customer service, and financial stability makes it a competitive choice in the market. However, it is important to carefully review the terms and conditions of any financial product or service before making a decision.

Given these insights, thorough research and caution are advised before engaging with IndusInd Bank.

Questions to Guide Your Review

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback

IndusInd Bank is a prominent Indian financial institution providing a wide array of banking products and services to individuals, corporates, and non-resident Indians. As a key player in the banking sector, IndusInd Bank offers services such as deposits, loans, credit cards, investment solutions, and online banking. Its operations are geared towards facilitating financial transactions, wealth management, and supporting economic growth through various lending and investment activities. It aims to be a technologically advanced and customer-centric bank, offering innovative solutions and personalized services to meet the diverse needs of its clientele. IndusInd Bank continually adapts to the changing financial landscape, focusing on regulatory compliance, risk management, and sustainable growth. They offer a full range of services, including retail banking, corporate banking, and wealth management.

All You Need to Know and How it Works

IndusInd Bank operates as a full-service commercial bank. Customers can open various types of accounts (savings, current, fixed deposits), apply for loans (personal, home, vehicle), and access credit cards. The bank also provides services like online and mobile banking for convenient transactions. For businesses, IndusInd offers corporate banking solutions including trade finance, cash management, and working capital loans. The bank earns revenue through interest on loans, fees for services, and investment activities.

What Makes IndusInd Bank Stand Out?

- Extensive Range of Financial Products: From basic savings accounts to complex investment solutions.

- Technological Innovation: Focus on digital banking platforms and mobile apps.

- Customer-Centric Approach: Aiming to provide personalized services and solutions.

- Corporate Social Responsibility: Engagement in various community development initiatives.

- Strong Financial Performance: Consistent growth and profitability.

How to Maximize Your Experience on IndusInd Bank

- Utilize Online and Mobile Banking: Conveniently manage accounts and transactions.

- Explore Investment Options: Consult with financial advisors to grow your wealth.

- Stay Updated on Offers and Promotions: Take advantage of special deals.

- Understand Banking Charges and Fees: Avoid unnecessary costs.

- Maintain a Healthy Credit Score: Improve your chances of loan approval.

Why Trust IndusInd Bank?

IndusInd Bank is a well-established and regulated financial institution in India, subject to the oversight of the Reserve Bank of India (RBI). It has a track record of financial stability and adherence to regulatory guidelines. IndusInd Bank's commitment to transparency, security measures, and customer service contributes to its trustworthiness. With a long history and a strong reputation in the Indian banking sector, IndusInd Bank is considered a reliable option for financial services.

FAQs

- What types of accounts does IndusInd Bank offer?

Answer: IndusInd Bank offers a variety of accounts, including savings accounts, current accounts, fixed deposits, and NRI accounts. - How can I apply for a loan from IndusInd Bank?

Answer: You can apply for a loan online through their website or by visiting a branch. You will need to provide necessary documents for verification. - Does IndusInd Bank offer online banking services?

Answer: Yes, IndusInd Bank provides comprehensive online banking services, including fund transfers, bill payments, and account management.

SUMMARY

IndusInd Bank is a significant player in the Indian banking sector, offering a wide range of financial services to individuals and businesses. Its focus on technology, customer service, and financial stability makes it a competitive choice in the market. However, it is important to carefully review the terms and conditions of any financial product or service before making a decision.

Given these insights, thorough research and caution are advised before engaging with IndusInd Bank.

Questions to Guide Your Review

- What has been your experience with IndusInd Bank's services?

- Have you encountered any issues with deposits, withdrawals, or account management?

- How does IndusInd Bank compare to other similar platforms you have used?

- Would you recommend this platform to others? Why or why not?

PawProfitForum does not endorse communities that promise unrealistic returns through potentially unethical practices. We are committed to promoting safe, informed, and ethical participation in the cryptocurrency space. We urge our audience to remain cautious, perform thorough research, and consider the broader implications of their investment decisions. All the above reviews include unverified information. Please conduct your own research. Share your feedback